Modus operandi on Excise Duty followed by Centre against spirit of Cooperative and Fiscal Federalism - Gehlot to Modi

Central government should reduce the Excise duty by an additional Rs 10 on Petrol and Rs. 15 on Diesel, which will reduce the VAT proportionately by Rs 3.40 and Rs 3.90 on Petrol and Diesel respectively.

"Rajasthan Government ready to bear the loss on VAT Revenue in light of public interest" - Ashok Gehlot

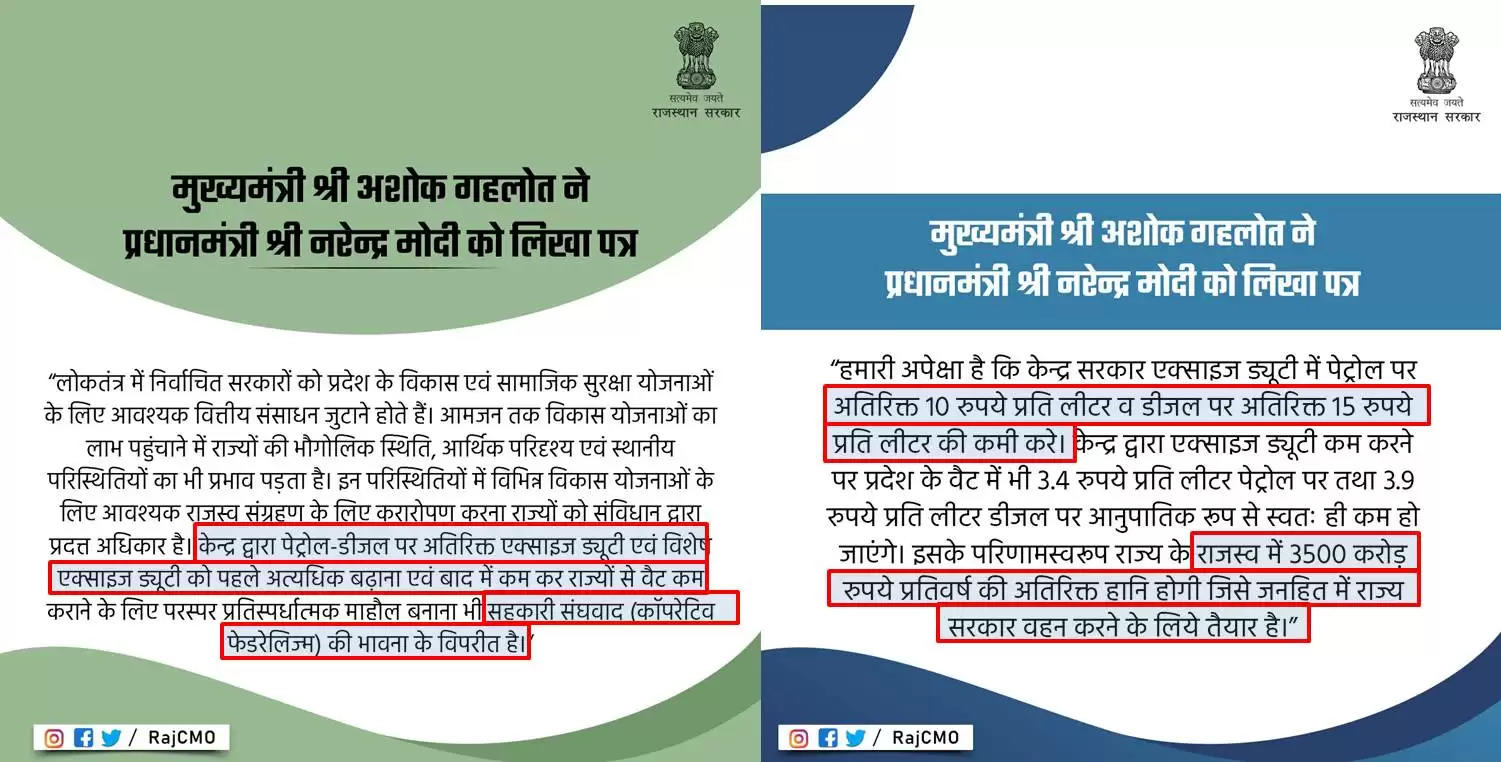

In a detailed letter to Prime Minister Narendra Modi, the Chief Minister of Rajasthan Ashok Gehlot advocated a further reduction in Excise Duty on Petrol and Diesel and committed that the state is prepared to bear the loss on revenue in order to pass on the benefits to the common man. Ashok Gehlot also attacked the Centre's modus operandi on the increase and decrease exercise being performed by the Central Government on the constituents of Excise Duty as detrimental to the principles of Cooperative Federalism and against the spirit of Fiscal Federalism in a Democratic State. His letter to the Union Home Minister Amit Shah, however maintained that the Rajasthan Government is prepared to bear the loss on VAT revenue in the light of public interest.

In his letter to the Prime Minister, CM Ashok Gehlot said that the earlier increase in the Additional Excise Duty and Special Excise Duty on Petrol and Diesel by the Center excessively and later reducing it to effect VAT revenue of the States resulting in creating a mutually competitive environment is contrary to the spirit of Cooperative Federalism.

"In a democracy, elected governments have to mobilize necessary financial resources for the development and social security schemes of the state. The effect of the geographical situation, economic scenario and local conditions of the states affects passing on benefits of development schemes to the common man. Under these circumstances, the states have the right given by the constitution to levy the necessary revenue for various development schemes. The increase of additional excise duty and special excise duty on petrol diesel by the Center first and then by reducing taxes and creating a mutually competitive environment to reduce the VAT revenue of States is also contrary to the spirit of Cooperative Federalism" - Ashok Gehlot

CM Gehlot added that continuous reduction in the share of the states revenue due to reduction in Basic Excise duty while increasing the Special and Additional Excise Duty is against the principles of Fiscal Federalism

"The basic excise duty levied on petrol and diesel by the central government from the year 2016 has been reduced to share with the states and the special and additional excise duty, of which the states do not get any share, has been increased continuously. The benefit of increase in additional excise duty and Agriculture Infrastructure Development Cess is being passed on to the Central revenue only, while the basic excise duty coming into the divisable pool has been progressively reduced, thereby reducing the share of taxes paid to the states. The continuous reduction in the share of the states is contrary to the principles of Fiscal Federalism" - Ashok Gehlot

In a parallel letter to the Union Home Minister Amit Shah, the Rajasthan Chief Minister said that his government, in the light of public interest, is ready to bear the loss in the state's VAT revenue.

"Despite the impact of COVID as well as other financial challenges, the State Government, in public interest is ready to bear the loss in the state's VAT revenue due to reduction in Excise duty on Fuel by the Central Government" - Ashok Gehlot

The Chief Minister in his letter to the Indian Prime Minister maintained that despite the circumstances laid bare due to COVID 19, the Rajasthan Government, with its efficient Financial Management, did not let the pace of development slow down. He added that state government is ready to fulfill public announcements and promises made in the budget in a time bound manner.

"More than 22% of the total revenue of the state of Rajasthan comes from VAT imposed of Petrol and Diesel. From 29 January 2021 till date, the State Government reduced its VAT by Rs 3 to a litre for Petrol and Rs. 3.8 per litre for Diesel. Due to this, there is a loss of Rs 2800 crore per year in the revenue of the state. Due to the circumstances of COVID-19, the revenue of the state has decreased by Rs 20 Thousand crores till the month of October 2021. One of the major contributors to this loss is the refusal of the Center in providing the GST chargeback of Rs. 5,963 crore to the state. Even in such a situation, our government did not let the pace of development in the state slow down due to efficient financial management. The state government is ready to fulfill the public announcement and promises made in the budget in a time bound manner" - Ashok Gehlot

The Chief Minister in his letter to PM Modi also suggested that the Additional Excise Duty and Special Excise Duty on Petrol and Diesel should also be reduced from the central pool in order to give comprehensive relief to the common man. He said that the states expect the Central government to reduce the Excise duty by an additional Rs 10 on Petrol and Rs. 15 on Diesel, which will reduce the VAT proportionately by Rs 3.40 and Rs 3.90 on Petrol and Diesel respectively. This will result in a loss of revenue of Rs. 3,500 Crore to the state, which his government is ready to bear towards public interest.

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal