Cyber Fraud Part 1 - Beware of Financial fraud through Phishing links

Avoid cybercrime by being knowledgeable about the risks involved with your Bank accounts

Nowadays, the term "cybercrime" is often used for all kinds of frauds using the internet or mobile, most of them being financial in nature. Many different sorts of fraudsters are doing all in their power to steal the information of your bank account. Don't let anyone else have control over your life's earnings; protect yourself.

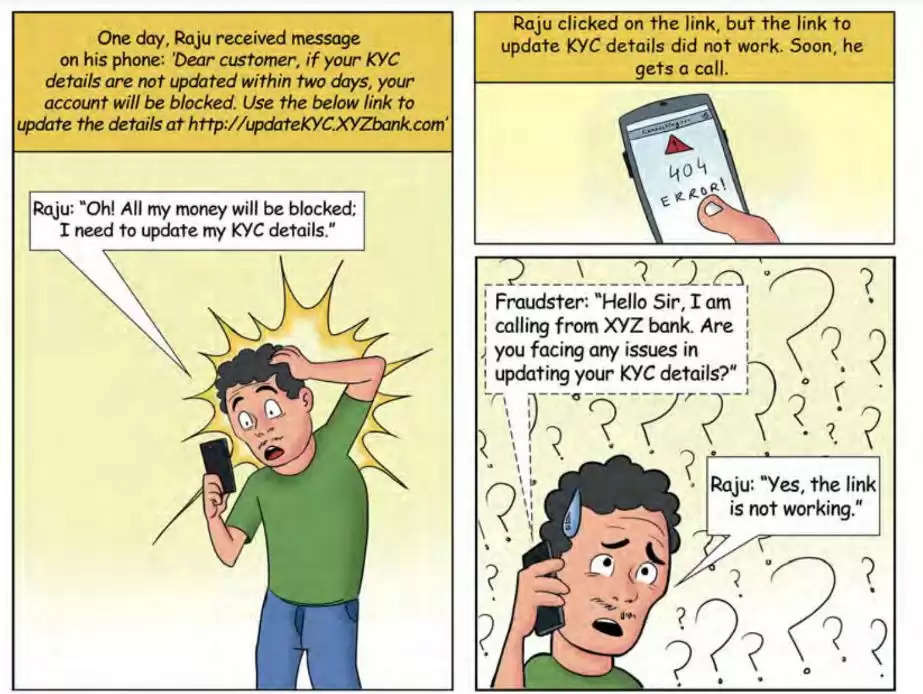

This post will talk about one of the strategies a fraudster uses to obtain all of your personal banking information. Frauds using phishing links is the first tactic, which I will be posting here. Social engineering attacks include Phishing attacks. Data such as credit card information and login passwords are hacked using it.

What causes it to occur?

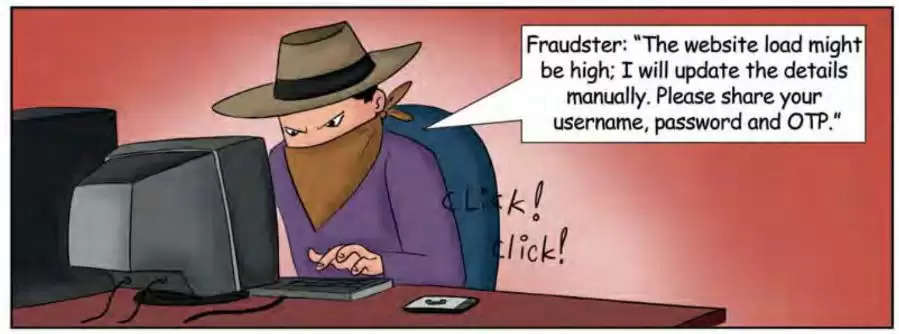

Before asking for your personal financial information, a fraudster will first urge you to trust him with it. You will receive a text message or an Email about your account that will warn you that if you don't confirm your bank account information, your account will be blocked.

Methods a fraudster use:

- Tricks the victim into opening an email.

- You are informed through text message or instant messaging to activate your account update.

Always keep in mind that a scammer will provide you a URL. The receiver is then duped into clicking a malicious link, which might install malware, cause the device to freeze as part of a ransomware attack, or reveal private data.

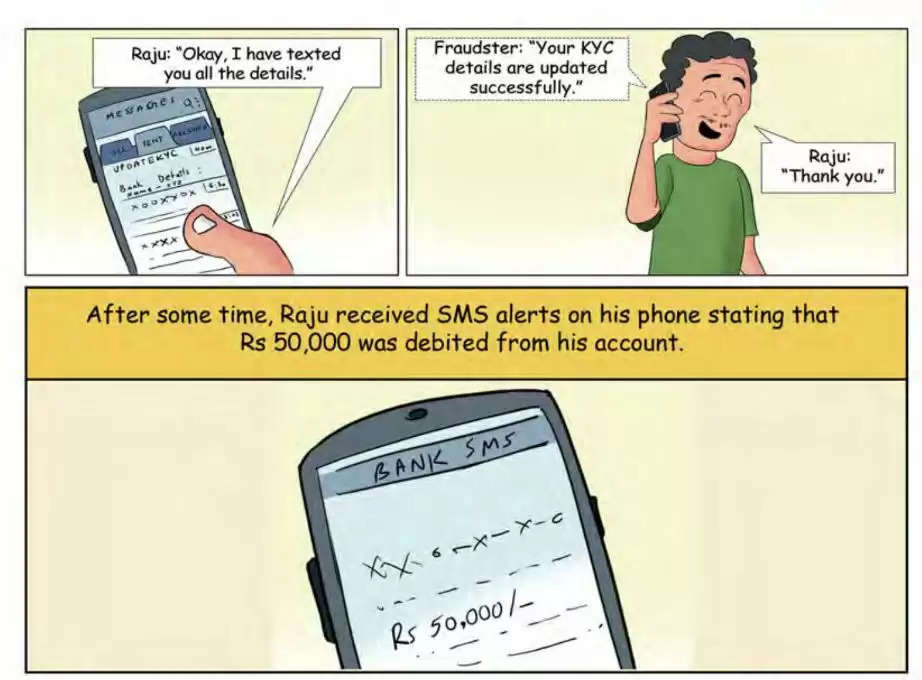

Result of this type of Fraud:

- There will be unauthorized purchases from your account.

- A financial theft.

- Significant financial losses.

Financial education is important. It should be easier for the people who are unfamiliar with the nuances of online financial transactions or who have just started their journey into the digital financial realm. Although it might happen to anybody, it is still advisable to be aware of all the techniques.

What to do when you get this type of call from a fraudster?

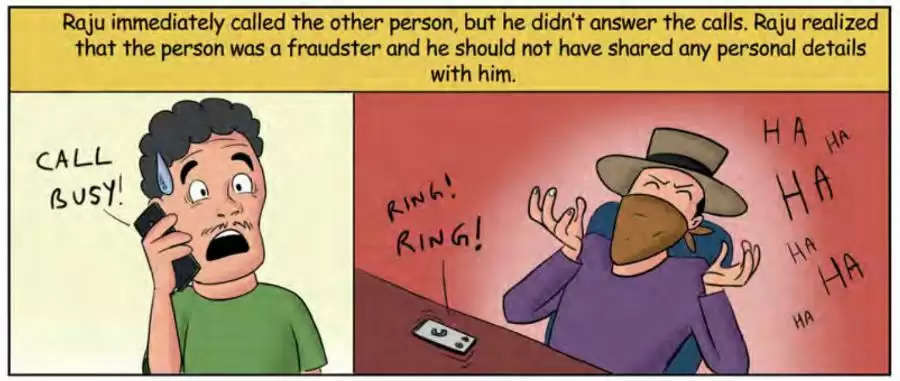

First and foremost, never click on unfamiliar, unsolicited links that you get by email or phone without first checking them. Keep your personal information private from strangers.

When you get calls, links, or SMS from unexpected sources asking you to update your bank information, always double-check the message with your home branch or through your relationship manager.

Report the occurrence to the local cybercrime police station and the National Cybercrime Reporting Portal at http://cybercrime.gov.in.

Sources: Click Link

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal