Cut your Taxes…not your Dreams!

Tax Planning is an integral part of your financial planning. Sec 80C of the Income Tax Act allows you to claim deductions from your taxable income by investing in certain investments. One of the most popular Sec 80C investments is in Tax saving mutual funds or Equity Linked Savings Scheme (ELSS)

Tax Planning is an integral part of your financial planning. Sec 80C of the Income Tax Act allows you to claim deductions from your taxable income by investing in certain investments. One of the most popular Sec 80C investments is in Tax saving mutual funds or Equity Linked Savings Scheme (ELSS).

This is an equity diversified fund and investors enjoy both the benefits of capital appreciation as well as tax benefits. Income earned at the end of the 3-year tenure is also exempted from taxation if it’s under Rs.1 lakh(on total equity Investment); any income over Rs.1 lakh is taxable at 10% under Long-Term Capital Gains (LTCG) tax.

Why ELSS ?

–Tax-Benefits: First and foremost benefit is tax savings upto Rs 1.50 lacs under Section 80C

–Lowest Lock-in Period– Compared to traditional tax saving instruments like Public Provident Fund (PPF), National Savings Certificate (NSC) and bank fixed deposits; the lock in period of an ELSS fund is much lower. While ELSS investment is locked in for 3 years, PPF investments are locked in for 15 years, NSC investments are locked in for 6 years, and bank fixed deposits eligible for tax deduction are locked in for 5 years.

–Achieving Short term goals– ELSS funds can also help you achieve your short term goals like Car purchase, Foreign Trips, Higher Education Fees and like

– Professionally Managed– As these are managed by qualified fund managers , you need not worry about knowledge on equity markets.

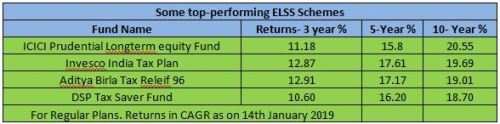

Better Returns– Historically ELSS funds have delivered better returns and have outperformed returns from other tax-saving instruments as Tax-saver FDs, PPF, NSC etc.

Below is a table reflecting 3, 5 and 10 year CAGR Returns of some top performing schemes:

When is the best time to invest in ELSS?

Investments in ELSS can be made at any time during the year. However most of us rush to invest in ELSS or tax-saving options during Financial year end from January to March.

The best time to invest in ELSS is however at the start of the financial year, i.e. in April. Since ELSS is an equity-oriented investment, it’s a good idea to invest via SIP mode and benefit out of Rupee cost averaging. To make the most of it, one may go in for a fortnightly or a weekly SIP and the amount can be as low as Rs 500 per SIP !

The Author-Saurabh Agarwal is an Ex-Citibanker and founder of The Wealth Advisors,Udaipur.

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal