What is Demonetization and Why it will Fail!

Demonetization is the act of stripping a currency unit of its status as legal tender. Demonetization is necessary whenever there is a change of national currency. The old unit of currency must be retired and replaced with a new currency unit. In economics demonetization is one of the tool to curb counterfeit and black money. Demonetization is an excellent tool to curb counterfeit money. The excellent example is in 1996 Australia released the world’s first long lasting and counterfeit-resistant polymer (plastic) banknotes. It replaced all paper-based notes, which the government systemically made non-tender for legal purposes. To curb black money no country implemented it successfully till now

The post

Demonetization is the act of stripping a currency unit of its status as legal tender. Demonetization is necessary whenever there is a change of national currency. The old unit of currency must be retired and replaced with a new currency unit. In economics demonetization is one of the tool to curb counterfeit and black money. Demonetization is an excellent tool to curb counterfeit money. The excellent example is in 1996 Australia released the world’s first long lasting and counterfeit-resistant polymer (plastic) banknotes. It replaced all paper-based notes, which the government systemically made non-tender for legal purposes. To curb black money no country implemented it successfully till now.

The Indian rupee (INR) is the official currency of the Republic of India. The Reserve Bank manages currency in India and derives its role in currency management on the basis of the Reserve Bank of India Act, 1934. On 8th November 2016 at 8:15 pm IST PM of India announced the invalidity of the currency notes of 500 and 1000 Rs from the midnight. The execution of demonetization of currency in India is on same line as USSR did in January 1991 known as pavlov reform after the name of the then Finance minister Valentin Pavlov. The same characteristics of exchange of notes in limited time period and in limited amount. The most resourceful people were able to park their money at the cost of the poor and illeterate people. The after effect was that within 2-3 months. Consumer goods prices rose by 300%. It was a total failure resulting in the loss of confidence in government action. In December 1991 USSR was disintegrated. I am not linking the disintegration of USSR to the demonetization policy but it may have played some role.

One of the biggest economy in world USA by its Coinage Act of 1965 prohibits demonetization of currency of all US coins and currency regardless of age. Whatever US does need not be correct; but the question is why not the economist of such a big economy thought in this direction.

History is taught to learn from the mistakes of the past. All the countries in the past who have taken demonetizaion as step to fight counterfeit and black money has failed miserably.

HISTORY OF DEMONETIZAION IN INDIA

First time demonetization was done in Pre Independence era in year1946. Post Independence the HDN currency of 1000, 5000 and 10000 Rs was demonetized in 1978 to curb counterfeit and black money. On 14 January, R Janaki Raman, a senior official from chief accountant’s office in RBI, was informed about the government’s decision to demonetise high-denomination notes and told to draft the ordinance. After the ordinance was drafted, it was sent to President N Sanjiva Reddy for assent. It was through the All India Radio’s (AIR) 9 am news bulletin that people were informed about the policy decision. The difference between today and past is that the current descision is dictatorial without the assent of President of India. This jeopardise the constitutional nature of our deomocracy where the head of the country is side lined in the name of secrecy. IG Patel, the then RBI governor, was not in favour of the step. He felt that many in the government perceived the step as a measure targeted at the “corrupt predecessor government or government leaders”. In his book, Glimpses of Indian Economic Policy: an Insider’s View, Patel writes that when the then finance minister HM Patel told him about the step, he asserted that steps like these rarely have striking results. He added that most people in possession of black money rarely keep their ill-gotten earnings in the form of currency for long. Thinking that black money is stashed away under mattresses or suitcases is naive, he said. “Black money stashed as high-value currency is much less than black money as untaxed income, part of which might be splurged in conspicuous consumption or used for investment in real estate, commodities, stocks, benami lending or plain graft to secure political or administrative goodwill,”

The same is the view of our previous RBI Governer Raghuram Rajan that “ steps like these rarely have striking results”

Did it work

Not in entirety, say economists, because high denomination notes returned eventually. And, such notes, as we know are the basis of corruption and illicit deals related to unaccounted money. The Rs 500 note was introduced in October 1987 and Rs 1,000 note was introduced in November 2000. The move was then justified as attempt to contain the volume of banknotes in circulation due to inflation. But in current scenario Rs 2000 notes has been introduced even before 500 and 1000 rs notes have been drained out completely.

Abhiroop Sarkar, Professor at Indian Statistical Institute, says the 1978 move had no effect on the circulation of black money. “That’s because people don’t stack black money in cash. Rather, they stash it in undisclosed accounts in Swiss Banks. So demonetisation won’t affect the big fish,” he explained to IANS. Here, it’s pertinent to mention that touts made most of the move in initial days. As people didn’t want to deposit their money in banks fearing tax problems, they fell for the touts instead. Anil Harish, a senior advocate told TOI, “At places like Crawford Market and Zaveri Bazar, people were selling Rs 1,000 notes for as little as Rs 300.” The same is happening today where at 20% to 30% discount the money is getting exchanged.

WHAT IS BLACK MONEY

In India black money is created by two means.

- By tax evasion

- Corruption

Tax evasion by the businessman. The businessman can again be classified in two categories. Small and average normal businessman and big corporates. Both of them evade tax due to wrong policies of the government. The small businessman are at the receiving end. The big corporates are generally friends of political parties and mostly are involved in funding of elections. The tax evasion can be stopped by using the technology at the right place. With the new Income tax software in place and linking of Adhaar card and Pan card with all the bank accounts can easily curb it but obvious with the political will.

Corruption by the government officials (politicians and beuracrates) is the biggest source of black money. Till the government takes any tough steps to stop the corruption, the generation of black money cannot be controlled; to stop it is a day dream.

REALITY OF COUNTERFEIT MONEY

According to a study done by the Indian Statistical Institute, Kolkata, in 2015, the only reliable and comprehensive exploration of the subject, at any given point of time ₹400 crore worth of fake notes were in circulation in the economy. This is merely 0.025% o f the total budget outlay of ₹19.7 lakh crore as announced this fiscal year.

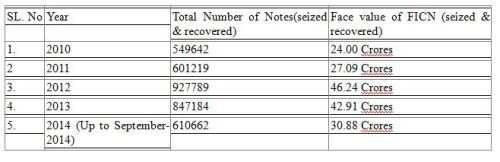

For the acutal figures which is unearthed the National Crime Records Bureau (NCRB) data says more than 1,80,000 fake currency notes of Rs 1,000 denomination (totaling Rs 18,00,00,000 ) were seized in 2015 by agencies like National Investigation Agency (NIA), CBI) and Directorate of Revenue Intelligence (DRI) among others. (Refer Appendix V)

6.9 pieces counterfeit notes per million NIC(Notes in circulation) are floating, on an average. Such numbers could have two extreme interpretations: (a) without any jugglery of numbers, this ratio could be simply higher at around 17 per million NIC if it is assumed that counterfeiting in lower denomination notes (less than 100 rupee) is negligible, which is more realistic.. Then the vis-à-vis position of outstanding fake notes works out to be of much higher rate, namely as high as about 44 pieces of counterfeit notes per million pieces of NIC

For detail visit: https://www.rbi.org.in/SCRIPTs/PublicationsView.aspx?id=14947

THE COST OF CURBING COUNTERFEIT MONEY

Replacing all the Rs. 500 and Rs. 1,000 denomination notes with other denominations, as ordered by the government, could cost the Reserve Bank of India at least Rs. 12,000 crore, based on the number of notes in circulation and the cost incurred in printing them. It includes the new prining cost as well as old currency cost which will be destroyed (source thehindu). This is just the printing cost. To add on will be the transportation cost and social cost. Social cost is the inconvenience to the common people, bank employees, transport employees etc. It is the intangible cost which cannot be quantified.

Is it sensible public policy to flush ₹12,000 crore down the drain to purportedly remove about ₹400 crore of fake currency.

SOME STATISTICAL FIGURES

- Cash recovery has been only 6% of the undisclosed income seized from income tax evaders, according to data from tax raids from 2012-13 onwards.

- In income-tax probes from April 1 to October 31 this financial year, black-money holders accepted having stashed Rs 7,700 crore worth of ill-gotten assets. The cash component was merely Rs 408 crore or 5%. The remaining was invested in business, stocks, real estate and benami bank accounts, the data show. Financial year 2015-16 saw the highest black-money detection in the period, of which 6% was cash.

- In 2012, the Central Board of Direct Taxes had recommended against demonetisation, saying in a report that “demonetisation may not be a solution for tackling black money or economy, which is largely held in the form of benami properties, bullion and jewellery”

- Also see Appendix III (source RBI Annual Report 2015-16)

WHY TO DOUBT THE INTENTION AND SECRECY OF THE PROJECT

- Urjit Patel RBI govener informed that the decision had been made about six months ago, and the printing of new banknotes of denomination ₹500 and ₹2000 had already started. Only the top members of few government agencies were aware of the move. The Reserve Bank governor six months before the announcement was Raghuram Rajan, while the new banknotes have the signature of the newly appointed governor,Urjit Patel. On the contrary the printing, according to officials, began in August-September (source economic times)

- On 1 April 2016 in a Gujarati newspaper called Akila, the news revealed regarding demonetization stating , that there would be around 2 months’ time to exchange banned notes, and that new notes in the ₹2000 denomination would be issued. The editor of the newspaper now says that it was only an April fools day prank.

- In Hindi daily Dainik Jagran, a fortnight before the official announcement the story of demonetizaion has been published.

- Thirdly, the BJP’s West Bengal unit deposited an unusually large cash amount of Rs 1 crore just before the move’s announcement.

TIME REQUIRED TO MAKE CASH FLOW NORMAL

- It will take more than seven months to replace the currency taken out of cirulation. The steps involved are

- To replace 14 trillion Rs taken out of circulation we need to print 17.5 billion notes. This number is based on the assumption that we print half the number of 500 Rs note and half of 2000 Rs note. With current capacity we can print about three billion notes per month. At this rate it will take almost six months. Urjit R. Patel assumed charge as the twenty-fourth Governor of the Reserve Bank of India effective September 4, 2016. Even if the mints began printing the replacement notes two months ago, after Urjit patel assumed charg it would still need around four more months to complete the printing. Either way, it would be longer than the 50 days Modi asked for. But printing the notes is only half the battle. Once the notes are printed, they need to be distributed to banks and ATMs so they can find their way into your wallet.

- Once printed, the notes are transported to the 19 Reserve Bank of India issue offices in major cities across the country.

- From the issue offices, the money is transported in high-security vans to more than four thousand currency chests across the country.

- Once a bank has the money in its currency chest, it can restock its bank branches in the surrounding area.

- From the bank branches, money is taken to nearby ATMs.

Given the several time-consuming processes required to circulate the new money, it may be difficult for the country to meet the prime minister’s fifty-day deadline.

PROBLEMS IN IMPLEMENTATION AND PAIN OF COMMON MAN

- The common man, who are illiterate and have no access to banking facilities, will be the ones to be hit by such steps.

- Most of the country’s ATMs are not built to accommodate the new ₹2,000 and 500 notes. Thousands of engineers are working as fast as possible to retrofit the country’s 2.18 lakh ATMs. This enormous undertaking is expected to take a few more weeks.

- Two lakh labours working for construction and other labour intesive business(Data for udaipur city). Out of this more than 50000 are jobless because the contractor does not have cash to pay them daily wages. No one can withdraw more than 24000rs in one week. All the construction sites are either closed or working with half labour.

- All small shopkeepers like cloth merchant, moblie shop, accessories vendor cannot procure goods. The cost of purchasing is somewhere between fifty thousand to one lac rs. The daily revenue which used to 2000 rs average a day has dropped to 300 rs per day.

- Who is responsible for the number of death of the innocent citizen who were deprived of medical facility due to lack of legal currency.

- The marriages which are getting affected contrast to the BJP minister spending 500 cr rs on his daughters marriage.

- Small vegetable farmers sitting road side cannot sell vegetables because people are now going to big balls to purchase vegetable by cards.

- Similarly small kirana shops sell has dropped to 10% in absence of legal currency.

- Products of non essential commodities have fallen and essential commodities are increasing. In two days the price of wheat has increased by 18%

- The price of agro products for next cycle will increase because farmers in absence of legal cash have missed the harvest season. Instead of using seeds they are using grains which will also result in poor yield.

- Till today around 5 lakh crore rupees have been deposited in bank(Source Dainik Bhaskar 21 November 2016). This has only sucked the liquidity from the market affecting the spending capacity of common man. It has nothing to do with black money.

- The head of All India Bank Officer’s Confederation, D Thomas Franco, on Monday called for the resignation of Reserve Bank of India (RBI) governor, Urjit Patel, on moral grounds because11 bank officials who died due to stress.

WHY TO DOUBT THE EXECUTION CAPABILITY OF GOVERNMENT

- The first promise to bring black money from swiss bank has failed.

- The second promise to deposit 15 lakh rupees in individuals account has failed

- The promise to strengthen rupee against dollar has failed.

- The promise to curb inflation has failed. The price of pulses, vegetables and other food items has increased by nearly 50% in last two years.

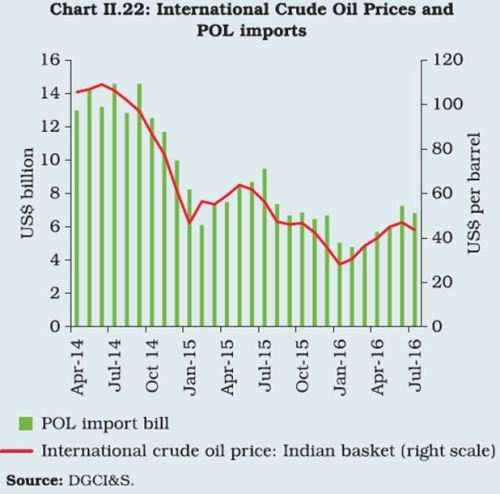

- The crude oil prices has decreased in the international market but the petrol and diesel prices in India has increased in last two years.(source RBI Annual Report 2015-16) See also Appendix II

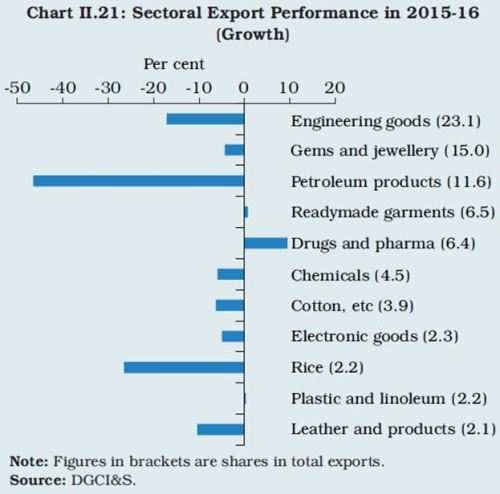

- After so many foreign trips by Prime Minister Mr Naredra Modi and the slogan “Made in India” the overall export declined by 15.5% in 2015-16. Non-oil exports declined by by 8.5 per cent, with exports of key products including engineering goods, electronics, leather and gems and jewellery contracting in terms of either volume or value or both. (source RBI Annual Report 2015-16) See also Appendix I

- The BJP party to promise to the young voter to create two crore jobs each year has failed. The Labour Bureau has compiled statistics for job creation in labour-intensive sectors in the country each quarter since the 2008 global financial crisis. The latest figures show that 1.35 lakh jobs were created in 2015, the lowest figure by far of any year since then — lower than the 4.9 lakh new jobs in 2014 and 12.5 lakh in 2009. In fact, the last quarter of 2015 recorded job losses. (Source thehindu)See also Appendix IV

- Textiles, leather, metals, automobiles, gems and jewellery, transport, information technology and the handloom sectors together created just 135,000 jobs during 2015, 67 per cent lower than 421,000 jobs that were added in 2014, the last year of the Manmohan Singh government.

- Anil Bokil the man who credited with the idea of demonetization is dissapointed. He said; this is not what we proposed. If the architect of the program backs out who will ensure the success of the project.

The failure of the government on above points whether treated as election jargons or implementation issues shackels our faith in government.

MISCELLANOUS

- The arguement of that the move will spur a cashless economy is flawed.

- How does replacing ₹1000 notes with ₹2000 ones help make the economy cashless?

- Total currency in circulation is less than 12% of GDP. The HDN is in fact 10% of GDP.

- So to reduce this 12% circulation of money in form of cash; the cost is very high. Due to the lack of infrastructure, village dirven economy, high illetracy rate, even higher digital illeteracy rate it is nearly impossible.

- When we talk about infrastructure only 46% banking penetration, only 22% internet connectivity, 19% of population without electricity connection (and others with unreliable connection) and only 1.2 million of 14 million merchants having point of sale devices.

- Infact many villages in India don’t have banks.

- Only 30% of Indians have access to financial institutions, including post offices and banks.

- 33% of the 138,626 bank branches are in 60 Tier-1 and Tier-2 cities, leaving rural India at a huge disadvantage.

- RBI has asked government banks to submit a roadmap on how many branches they will be opening by 31 March 2017 in villages with more than 5000 population.

- This only suggest that after 31 March 2017 villages with population less than 5000 will still be deprived of banking facility.

- Let say if we make 20 transactions a day most of our transactions are for our daily needs of bread and butter. In terms of volume even if the amount is less the number of transactions is very high. Transactions involving big amount are very few in number.

- People looses faith in the banking system if 85% of the currency is suddenly declared invalid for transaction. This has only resulted in switching over to physical assets and foreign currency proven by historical facts.

- The claim that things will fix in 50 days is flawed. If it will take 7 months to bring money in circualation how will economy come in track in 50 days

ALTERNATE PATH

Since only 6% of the total cash is in form of black money, and counterfeit currency is .025% of our total GDP demonetization does not help. Instead the following steps would have

- Like Australia released the world’s first long lasting and counterfeit-resistant polymer (plastic) banknotes the government should have waited for some time and adopted the same technique.

- To remove counterfiet currency the old currency can be drained out of main economy slowly without affecting common man.

- To curb black money

- Strike on top 25 black money hoarders names (From Panama Paper Leaks, HSBC List, Leichtensttein Banks) to get back 99.9% of the Black money.

- Strike on benami property papers.

- The another bold decision governemnt can take is Like America did in 1933. From 1933 to 1974, when the government banned most private ownership of gold bullion, including gold coins held for non-numismatic. Only ladies can have ornamental gold capped by upper limit.

- We for sure know which administrative post is the seat of corruption. Raid all the officers of such post. Maximum black momey in form cash lies with them. Dont we know which all departments are centres of corruption. Start from India’s Top 50 Cities

- Approve RTI on campaign funds for elections.

- Dont we know how many politicians are corrupt. More than 50% of the lok sabha members have criminal cases filed against them. IT raids on all political leaders having disproportionate wealth. Need to close as fast as possible.

- Implement Lok pal bill that house passed.

Its not a bold decision its a suicide.

The poets rightly says “Lamho ne khata ki sadiyon ne saza pai”

APPENDIX I

APPENDIX II

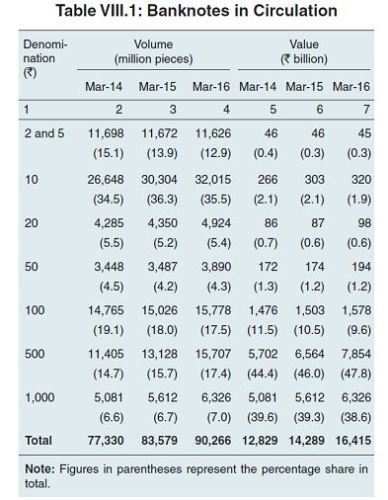

APPENDIX III

In terms of value, the annual report of Reserve Bank of India (RBI) of 31 March 2016 stated that total bank notes in circulation valued to ₹16.42 lakh crore(US$240 billion) of which nearly 86% (around ₹14.18 lakh crore (US$210 billion)) was ₹500 and ₹1000 banknotes. In terms of volume, the report stated that 24% (around 22.03 billion) of the total 90266 million banknotes were in circulation.

The annual report of Reserve Bank of India (RBI) of 31 March 2016 stated The increase in gross financial assets was driven primarily by a turnaround in small savings and increases in investment in equities and mutual funds, tax-free bonds by public sector units and currency holdings. From the table below of the 10.8% of saving 1.4% saving is in form of currency (it means cash and not bank deposit). This saving is accumulated over the period of time in the form of cash. Many people are afraid that these small savings in form of cash will come under income tax scrutiny as we know how honest our government department officials are and government because of its inability to curb corruption they had taken this step.

APPENDIX IV

Changes in employment of direct and contract workers based on the latest four survey results (in thousand)

APPENDIX V

As per the statistical data maintained by the National Crime Record Bureau (NCRB), the total number of counterfeit currency (recovered and seized) and the face value thereof during the last five years i.e 2010, 2011, 2012, 2013 and the current year up to September 30, 2014 is as under:-

*Source http://pib.nic.in/newsite/PrintRelease.aspx?relid=113525

Contributed by: Gazanfer Ali, IQRA, UdaipurTo join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal