Bajaj Finance Fixed Deposit- Why Is FD The Best Investment Option For Risk-Averse Investors?

The performance of market-linked funds dwindled in 2018, as most economic indicators saw a significant decline in 2018. By the end of 2018, the value of rupee was down by 9%, and stock market gains in NIFTY were wiped out as 20-60% stocks fell from their yearly highs.

The performance of market-linked funds dwindled in 2018, as most economic indicators saw a significant decline in 2018. By the end of 2018, the value of rupee was down by 9%, and stock market gains in NIFTY were wiped out as 20-60% stocks fell from their yearly highs.

The returns from mutual funds also turned negative during 2018, which in turn slowed down foreign investment in mutual funds. Bonds, which usually give a stable return, also fared badly as most companies chose to borrow funds from outside India.

Such investment options certainly do not suit the investment profile of risk-averse investors, as they are at risk of losing their capital amount with these investments.

Why is FD better than other low-risk investment options?

Safe investment options like fixed deposits, EPF, PPF, post-office schemes, debt mutual funds, bonds, and company debentures are ideal for risk-averse investors. However, most of these instruments have limitations in terms of liquidity, interest rate movements, lock-in period, and more.

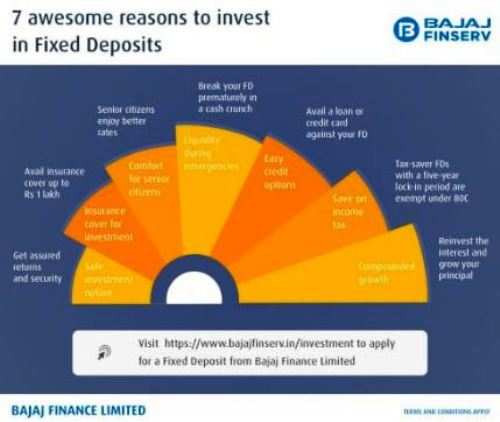

Among all these options, fixed deposit stands out for its high returns, safety, and flexible investment terms. It has emerged as the instrument of choice for risk-averse investors to keep their money locked in at a stable rate while ensuring high growth. Here’s why:

- Assured returns on maturity – Returns on fixed deposits are not affected by market fluctuations. Upon maturity, you will earn the amount you are entitled to. It is highly suitable for risk-averse investors, as the rate of interest is pre-determined.

- High interest – Fixed deposits offer high interest rates as compared to other fixed-income investment options. EPF and SCSS (Senior Citizen Savings Scheme) offer an interest rate of 8.65% and 8.7% respectively whereas NSC and PPF offer 8%. However, company fixed deposits like Bajaj Finance Fixed Deposit offer interest rates up to 8.95% with an additional benefit of 0.10% on renewals.

You can lock in FDs at higher interest rates and not only safeguard your portfolio against market fluctuations, but also build a substantial corpus.

- Flexibility in investment terms– Unlike other fixed-income investment instruments, fixed deposits offer great flexibility in investment terms.You can choose from various options of tenor – ranging from 7 days to 10 years. The principal amount can be decided as per your discretion (starting from Rs. 1000).

- The cumulative option – In case of a cumulative FD, the interest accumulated during the tenor of the FD is added to the principal amount and re-invested. So, your principal amount will increase by the amount of interest you earn during a specific period. Hence, your total invested amount will increase, and the returns will be higher upon maturity. Cumulative FD works best for risk-averse investors looking for high growth as it has a snowball effect on the returns due to the feature of compounding.

- Liquidity– PPF and EPF are mainly aimed at building a retirement corpus as they do not allow withdrawal before certain time conditions are met. Bonds and other instruments also take their time. However, you can easily go for premature withdrawal of fixed deposit and receive immediate credit in your account. You can also borrow a loan against FD.

How risk-averse investors can benefit from investing in FDs

If you are a risk-averse investor, you should have a certain portion of your investments earning stable and high returns. This is more important if you have a growing family or if you are planning to start a family. Careful planning of investments is required to support the expenditure of a burgeoning family, aging parents, and growing kids.

Your investments should mature at an appropriate time and provide stable and high returns in any volatile scenarios. Planning FD investments one after the other at periodic intervals will give a steady stream of payments at maturity. Staggering your FD investments in this manner will also help you to benefit from the changes in interest rates, thus giving the best returns.

Bajaj Finance FDs offer the flexibility to choose tenor as per your requirement, thus making it easy for you to ladder your FDs across different time frames and interest rate slabs. Your returns are guaranteed as these fixed deposits have been rated FAAA/stable by CRISIL and MAAA/stable by ICRA.

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal