Cut your taxes, not your dreams | Rush to make your investments and claim benefits under Sec 80C

Tax Planning is an integral part of your financial planning. Sec 80C of the Income Tax Act allows you to claim deductions from your taxable income by investing in certain investments. One of the most popular Sec 80C investments is in Tax saving mutual funds or Equity Linked Savings Scheme (ELSS).

This is an equity diversified fund and investors enjoy both the benefits of capital appreciation as well as tax benefits. Income earned at the end of the 3-year tenure is also exempted from taxation if it’s under Rs.1 lakh(on total equity Investment); any income over Rs.1 lakh is taxable at 10% under Long-Term Capital Gains (LTCG) tax.

Why ELSS ?

-Tax-Benefits: First and foremost benefit is tax savings upto Rs 46800/- by investing 1.50 lacs under Section 80C in one financial year.

-Lowest Lock-in Period- Compared to traditional tax saving instruments like Public Provident Fund (PPF), National Savings Certificate (NSC) and bank fixed deposits; the lock in period of an ELSS fund is much lower. While ELSS investment is locked in for 3 years, PPF investments are locked in for 15 years, NSC investments are locked in for 6 years, and bank fixed deposits eligible for tax deduction are locked in for 5 years.

-Achieving Short term goals- ELSS funds can also help you achieve your short term goals like Car purchase, Foreign Trips, Higher Education Fees and like

- Professionally Managed- As these are managed by qualified fund managers , you need not worry about knowledge on equity markets.

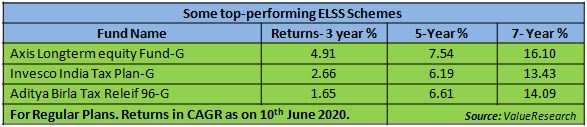

Better Returns- Historically ELSS funds have delivered better returns and have outperformed returns from other tax-saving instruments as Tax-saver FDs, PPF, NSC etc.

Below is a table reflecting 3, 5 and 10 year CAGR Returns of some top performing schemes:

When is the best time to invest in ELSS?

Investments in ELSS can be made at any time during the year. However most of us rush to invest in ELSS or tax-saving options during Financial year end from January to March.

This Year due to lockdown, the date for making various Investments/payment for claiming deduction under Section 80C (ELSS,LIC, PPF, NSC etc.), 80D (Mediclaim), 80G (Donations), etc. has been extended to 30 June 2020. Hence the Investments/payment can be made up to 30 June 2020 for claiming the deduction under these sections for FY 2019-20.

However for Salaried Employees ,Most companies would have closed the IT Computation for TDS, hence they may not be able to consider the additional Investment done by the employee during the extended period. However Employees can claim refund on additional Investments made during the extended period at the time of filing IT Returns for FY 2019-20 for the higher taxes deducted by the company.

Please note ELSS Investments done during April to June 2020 will be eligible for deduction either in FY 2019-20 or FY 2020-21. One has the option in which FY he/she wants to claim deduction BUT care should be taken that NO DOUBLE deduction across both financial years is claimed on the same Investment !

Secondly, The NAV of above 3 funds have corrected by 20% from their peak NAV currently(as on 11th June) and thus the 3 & 5 year returns are in single digits as above. ELSS have historically delivered superior double digit returns. This is actually the right time to Invest in ELSS funds at lower NAVs due to considerable market correction and avail twin benefit of Tax savings and Wealth creation !

Since ELSS is an equity-oriented investment, it’s a good idea to invest via SIP mode and benefit out of Rupee cost averaging. To make the most of it, one may go in for a fortnightly or a weekly SIP as well !

The author, Saurabh Agarwal is an Ex-Citibanker and founder of The Wealth Advisors and LoanGurus. Views are personal.

Can be reached at saurabhaggrawal@yahoo.com or www.thewealthadvisors.co.in

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal