How to prepare your Investment Portfolio for 2020

Financial experts predict 2020 to be fruitful one for the Indian economy, and cite growth in domestic consumption and investment as sources of impetus. In fact, the World Economic Situations and Prospects (WESP)’s 2019 mid-year update projects economic growth to the tune of 7.1%. Considering that the coming year seems promising, now is a good time for you to place your finances in profitable avenues. Withjust a month to go before the New Year commences, its best that you review your finances immediately and prepare investment plans right away.

Secure returns via fixed deposits

A fixed deposit is one of the oldest and safest investment avenues that you can opt for. Moreover, what makes an FD a truly good pick is that returns are not market-linked and hence, do not require constant monitoring. While choosing an issuer, however, make sure that you check for credibility ratings as these ensure that your finances are in safe hands.

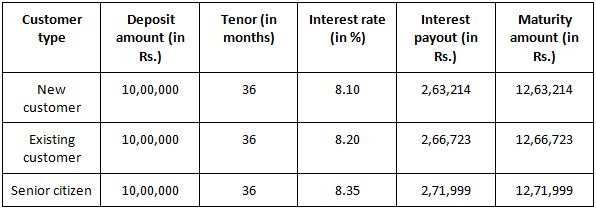

For instance, invest in Bajaj Finance Fixed Deposit as it carries the highest stability ratings from CRISIL and ICRA, FAAA and MAAA respectively. Additionally, 0 unclaimed deposits, a YoY growth of 60%and a deposit book of Rs.17,633 crores as per Q2 results,attest to its quality. Best of all, Bajaj Finance offers generous yields alongside stability, withFD interest rates that go up to 8.10%, 8.20% and 8.35% for new, existing and senior citizens, respectively. You can choose to invest for a flexible tenor that ranges up to 60 months and can opt for regular payouts too, should you need periodic financial assistance. To maximise the FD’s yields, remember topick a tenor of 36 months or more and selectpayouts at maturity only.

To tailor your investment to your goals, you can use the onlineFD calculator. Below is a table depicting how you can grow your wealth with this handy instrument.

Opt for an investment in gold

This traditional investment tool is expected to give substantial returns in 2020, especially by Diwali.Experts are also of the opinion that your investment portfolio should contain at least 10% of gold investments. This is because you can bank on gold when the market goes through a period of volatility, and you can avail a loan against gold deposits when tackling a cash crunch.

However, as holding and storing physical gold isn’t cost-effective, investing in gold ETFs is an alternative that you can consider. You can do so by either making a lump sum investment or through an SIP. An advantage that the former offers is that you benefit from favourable and transparent pricing.

Get two-in-one benefits by investing in ULIPs

Investing in Unit-Linked Insurance Plans make for a smart move as ULIPs offer you coveragewhile also allowing you to accumulate funds foryour goals. When you invest in ULIPs, a part of the amountgoes towards insurance, while the remaining is either invested in equity or debt funds, based on your risk profile. Doing so also lets youbalance your investment portfolio, and asthe maturity amount is exempt from tax under Section 10 (10D) of the IT Act, ULIPs become all the more advantageous.

Strike a balance with mutual funds and PPF

Creating a balanced investment portfolio that has a mix of low- and high-risk investments is essential to navigating the ups and downs of 2020 like a pro. To ensure that you have a diverse investment portfolio, you can consider investing in equity funds and in a PPF. Investing in equity helps you grow your wealth vis-à-vis higher return rates. Similarly, PPF gives you stability and tax-free, compounded interest gains over a tenor of 15 years.

Now that you know how to prepare for 2020, start by creating a strong financial base by investing in an FD. When doing so, remember that Bajaj Finance is ranked as one of the safest investment options. It is the only NBFC in India to have a long-term issuer credit rating of ‘BBB-’ and short-term issuer credit rating of ‘A-3’ by S&P Global. To booka Bajaj Finance Online FD all you need to do is request a call by providing basic details.An authorised representative will then get in touch with you and guide you through the procedure.

So harness the power of these simple investment moves and make 2020 your most financially rewarding year yet!

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal