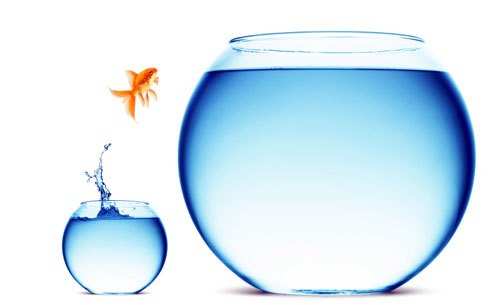

If you Risk nothing, then you Risk Everything

To live is to risk dying. To try is to risk failure. To hope is to risk despair. To place your ideas, your dream before the crowd is to risk their loss. But risk must be taken because the greatest hazard in life is to risk nothing.

Why Should We Be Receptive to Risks?

To live is to risk dying. To try is to risk failure. To hope is to risk despair. To place your ideas, your dream before the crowd is to risk their loss. But risk must be taken because the greatest hazard in life is to risk nothing.

Life doesn’t come with guarantees. Security is mostly a superstition. Avoiding danger is no safer in the long run than outright exposure. Risk Management doesn’t mean Risk Free. For years, the banking industry has boasted of having the best risk management and ERM programs of any industry.

None of that however, prevented the 2007 credit crunch and mortgage meltdown. The recent crude oil price fluctuation has once again dismantled all the analysis models, the spread sheets containing logical price forecast by oil industry experts have dumped to the ‘recycle bin’ and they have rather turned to the Almighty, seeking divine guidance to get enlightened on the oil market dynamics.

Risks bring new pleasures and accomplishments. It can expand the horizons and open the world for us. It’s easy to get caught up in ‘analysis paralysis’ and spend days sketching out the perfect route to achieve goals. An imperfect start beats a perfect daydream on paper any day.

Go after your dream and aim for forward motion every day, no matter how small. Regret at never trying can be harder to live with than trying and failing. And what you learn may lead to an even bigger dream that you couldn’t even see before. Those past mistakes and failures have now given greater strength and resources than you did in the past. If things seem under control, you are just not going fast enough.

When you see life as a game it changes your whole attitude about winners and losers. Games work best when even those who lose still have fun. You might as well take a risk and see what you are capable of. Otherwise, you’re just sitting at the table watching life play out in front of you. If you don’t take risks, you’ll never feel quite complete. Right up until the day your story ends. A ship in harbor is safe – but that is not what ships are for!

There is a direct relationship between risk and reward. The greater the potential upside, the greater the risks involved. As an aside, it’s worth noting that the converse is not necessarily true. Situations that involve great risk sometimes have little or no upside. These are stupid risks to take. The risk taker is to be aware of the worst possible outcome and to be prepared to deal with it.

A calculated risk is the one you take after you become aware of both the positive and the negative outcomes of your decision. For entrepreneurs, this means that if you want to have a chance at success, you have to take significant risks. Entrepreneurship is neither easy nor risk free.

While risk is an integral part of entrepreneurship, it doesn’t have to get the better of you. Great entrepreneurs achieve success through keen awareness and management of risks. Calculated risk taking is when entrepreneurs study all expected risks, and think of solutions that will help them combat those risks, thus making the potential risks less threatening.

The investment landscape is constantly changing and it is important to get a handle on which companies are doing a good job at managing enterprise risk. Really good finance people need to be much better leaders than the traditional financial control- and reporting-focused accountants. They need to act more like business partners. As part of any senior finance career, they need to spend time in general management roles.

It is really about becoming a broader-skilled person who can help to lead the senior team in making those resource-allocation decisions.

Determined and persisting business performance is ultimately what’s required to make effective decisions when it comes to innovation and risk management. You need somebody who has the capability to support those decisions, making the trade-offs, understanding the numbers and developing the business case. They are best placed to drive the discussion about how you can balance your innovation portfolio with your financial targets.

If you think of aggressive decisions, performance management and then portfolio management, those are probably three of the things that you want to see in a finance leader.

The authors of this article is Ruqaiya Pachisa from Udaipur. Presently residing in Qatar, she is a Chartered Accountant and currently involved in Financial Management, Business Planning & Analysis and Policy formulation. She is currently the Executive member of Doha Chapter of The Institute of Chartered Accountants of India. She also represents the Committee of Women in Finance and Accounting in Qatar.

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal