IT Returns for AY 2018-19 extended – can be filed till 31 August without penalty

The ITR deadline for e-filing of returns for AY 2018-19 (Y 2017-18) has been extended by a month to 31 August 2018...read on

The ITR deadline for e-filing of returns for AY 2018-19 (Y 2017-18) has been extended by a month to 31 August 2018.

Last year, the deadline, which was 31 July 2017 for AY 2017-18 was also extended by 5 days to August 5, 2017. Multiple amendments, requirements such as linking PAN and Aadhaar, compulsory quoting of Aadhaar in Tax returns, delay in receiving TDS certificates, CAs being busy with GST returns and to top it all, the tax departments website not working properly at times, shutdowns – all of these led to Chartered Accountants being in favor of extending the deadline last year.

Advertisement

This year however, the deadline was 31 July 2018 and there was a penalty of upto Rs 10,000 if the filing was not done by the due date.

The Ministry of Finance, has probably taken into cogniscance the previous years circumstances and provided a months leverage and extended the deadline by another month. Not filing the returns by 31 Aug will attract penalties of upto Rs 10,000.

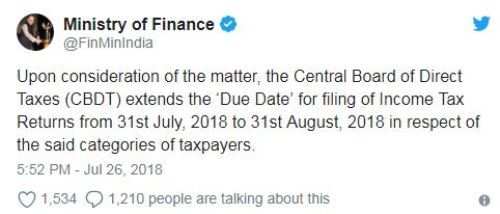

“The Due Date for filing of Income Tax Returns for Assessment Year 2018-19 is 31.07.2018 for certain categories of taxpayers… Upon consideration of the matter, the Central Board of Direct Taxes (CBDT) extends the ‘Due Date’ for filing of Income Tax Returns from 31st July, 2018 to 31st August, 2018 in respect of the said categories of taxpayers” – Ministry of Finance

Click here to Download the UT App

However a weeks extension will not make things any simpler…most will probably just procrastinate and others will hurry with other priorities and wait for the last week once again.

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal