Moratorium Decoded- Should you go for it?

Reserve Bank of India (RBI) has extended the loan moratorium period by 3 months till August 31, 2020. This covers all term loans Mortgage, home, auto ,Business ,personal ,CV/CE, education loans including credit card dues . The moratorium is an extension to the prior announcement regarding same starting March. The Total Moratorium now stands at 6 Months starting March 2020.

Also for Working Capital facilities, RBI has asked all lenders to convert the accumulated interest of 6 months into a Funded Interest Term Loan, which is to be fully repaid by March 2021.

Moratorium is NOT a Waiver:

Moratorium refers to the period of time during which you do not have to pay an EMI on the loan taken or we can call it an EMI holiday. Here please note that EXTENSION is not a waiver but a deferment of your EMI and the Interest (compound –i.e. Interest on Interest) will continue to get accrued on your Loan Outstanding!

This Moratorium was much needed and is beneficial for people in Unorganized sectors, employees of MSMEs facing salary delays, small business owners, small vendors, job-losers and all self employed facing cash crunch due to COVID Lockdown.

By Availing Moratorium, borrower’s credit score will not get impacted and NO Late payment charges will be levied for Credit Card dues neither will they be blocked by issuer during moratorium.

As on April 30, 2020, Major large banks indicated that the proportion of customers availing the moratorium has been in the range of 25-35% (Rupee value terms), while for small finance banks, the moratorium rate has been much higher. Like the customer percentage availing moratorium for Equitas Bank stood at 93%, Ujjivan Bank at 90 % and for Bandhan Bank it was around 70 % of the total loan portfolio.

The Devil is in the details

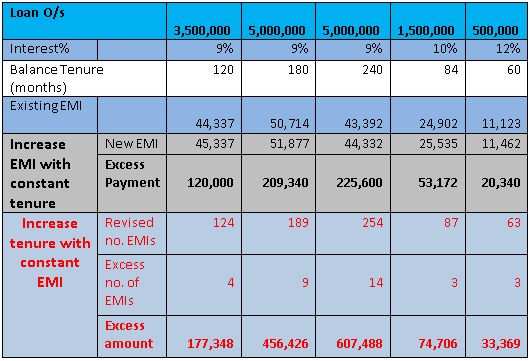

If you avail Moratorium for say 3 months, the Interest accrued (compounded Interest) during the period will get added to your Principal Loan outstanding thereby increasing your overall loan amount. After the Moratorium is over, you may have 2 options i.e. (1) either increase the EMI amount or (2) Increase the Loan Tenure. (Borrowers are however advised to contact their respective RM/Bank for the revised Amortization Schedule and T&C’s). Understand this by the table illustration below considering a range of outstandings and related interest rates:

Should you avoid it or Avail it? – This depends on how much one is affected by the Lockdown. Those who are genuinely impacted and unable to pay like people in Unorganized sectors, employees of MSMEs facing salary delays, few private sector employees,small business owners, small vendors, job-losers, self employed facing cash crunch or people without any Emergency Fund*(Which Covers 6 month EMIs plus Household expenses including medical cover) , the moratorium is the Right option for them as of Now.

Again Moratorium should not be availed for Loans with High Interest Rates as Personal Loans or Used Car Loans and should be completely avoided for Credit Card Dues as far as possible given their Interest Charges being as high as 25-30% p.a.

Secondly, most private banks and NBFC’s currently are not offering enhancement and offering Balance Transfer Top-ups to clients who have availed Moratorium. Availing Moratorium is being viewed negatively by the lenders. This can deprive the good clients of better Interest rates and loan enhancements so this option should be opted wisely considering all above!

The author, Saurabh Agarwal is an ex-Citibanker and founder of The Wealth Advisors and LoanGurus. He can be reached at saurabhaggrawal@yahoo.com. The view expressed are his own.

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal