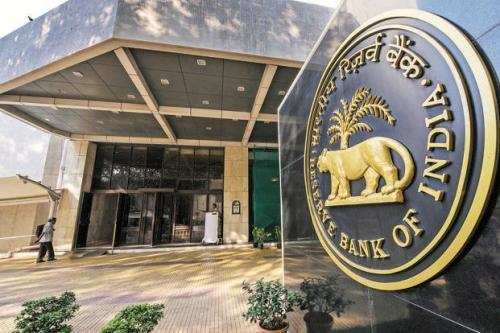

RBI breaks on Interest Rates will help the real estate sector as well as home buyers

The RBI has also suggested that in order to contain rising fuel prices,Excise duties, Cess and Taxes imposed by the Centre and States need to be adjusted in a coordinated manner to contain input cost pressures emanating from petrol and diesel prices.

Reserve Bank of India (RBI) has kept the interest rates unchanged in the Monetary Policy anounced today. The repo rate has been kept at 4 per cent. The reverse repo rate or the central bank’s borrowing has been unchanged at 3.35 per cent. Experts earlier predicted that RBI is likely to keep the policy rates unchanged and maintain accomodative stance amid the growing uncertainty over COVID-19 pandemic. The fears of firming inflation also refrained the RBI MPC from tinkering with the interest rates on June 4.

The Reserve Bank of India (RBI) Monetary Policy committee has kept the interest rates unchanged. A move that is expected to help homebuyers as well as the real estate sector. Unchanged rates mean that home loans won't get expensive and buyers can continue to take advantage of the prevailing low rates, which is also expected to sustain demand.

Key highlights:

- The repo rate has been kept at 4 per cent.

- The reverse repo rate or the central bank’s borrowing has been unchanged at 3.35 per cent.

- CRR has been changed to 4%.

- SLR has fixed to 18%.

- Bank rate is 4.25%.

- MSF is also 4.25%.

These rates are revised every 5 years last changes were made in 2016. These rates are valid till 2026. RBI has kept inflation rate (consumer price index rate) at 4% ± 2% (ranging between minimum 2% and maximum 6%).The Reserve Bank has revised downward the economic growth forecast for the financial year 2021-22 to 9.5 percent from 10.5 percent. And has projected CPI inflation at 5% during 2021-22.5.2% in Q1, 5.4% in Q2, 4.7% in Q3, and 5.3% in Q4, with risk broadly balanced.

If we talk about facts, in April the CPI inflation rates as compared to March has reduced, from 5.52 to 4.29 respectively. This indicates RBI is on the right track. Why? Because as the CPI inflation rates are kept at 4% (± 2%) so if the inflation is moving towards balance there is no need to change the repo and reverse repo rates. The policy stance is a logical step to support the actual GDP growth of 1.6 percent that was reflected in Q4 FY 2020-21, economists said.

However, growth was likely to be hit by the after-effects of the second COVID wave, which has battered the country.

Existing borrowers and those looking to take a new loan (be it home loan, car loan, or personal loan) can take advantage of the brakes applied by the RBI.

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal