How to Find Short Term Trade Ideas for Option Trading?

Short-term trading ideas can be successfully implemented by doing market and technical analysis of underlying assets that are related to option contracts. In a short period, you have to continuously analyze the price of the underlying asset. In this way, you can take buy and sell positions as per the market conditions.

In this article, you’ll learn about the steps of finding short-term option trading ideas. You’ll also get to know about the implementation of these ideas.

Ways of Finding Short-Term Option Trading Ideas

In stock options trading, you can buy and sell contracts having a near-month expiry. It means letting go of next-month and far-month expiry contracts. In index options, you will trade in a near-week expiry contract rather than a far-week expiry contract.

Here are some of the ways that can help you select the best option contracts for short-term trading:

-

Choosing a Derivative Trading App

Firstly, you have to download an option trading app on your smartphone and open a Demat account in it. You need to keep in mind that a selected derivative trading app is from a stockbroker who is registered with SEBI (Securities and Exchange Board of India). An exclusive app for options trading will also help you in keeping an eye on minute details in the short run.

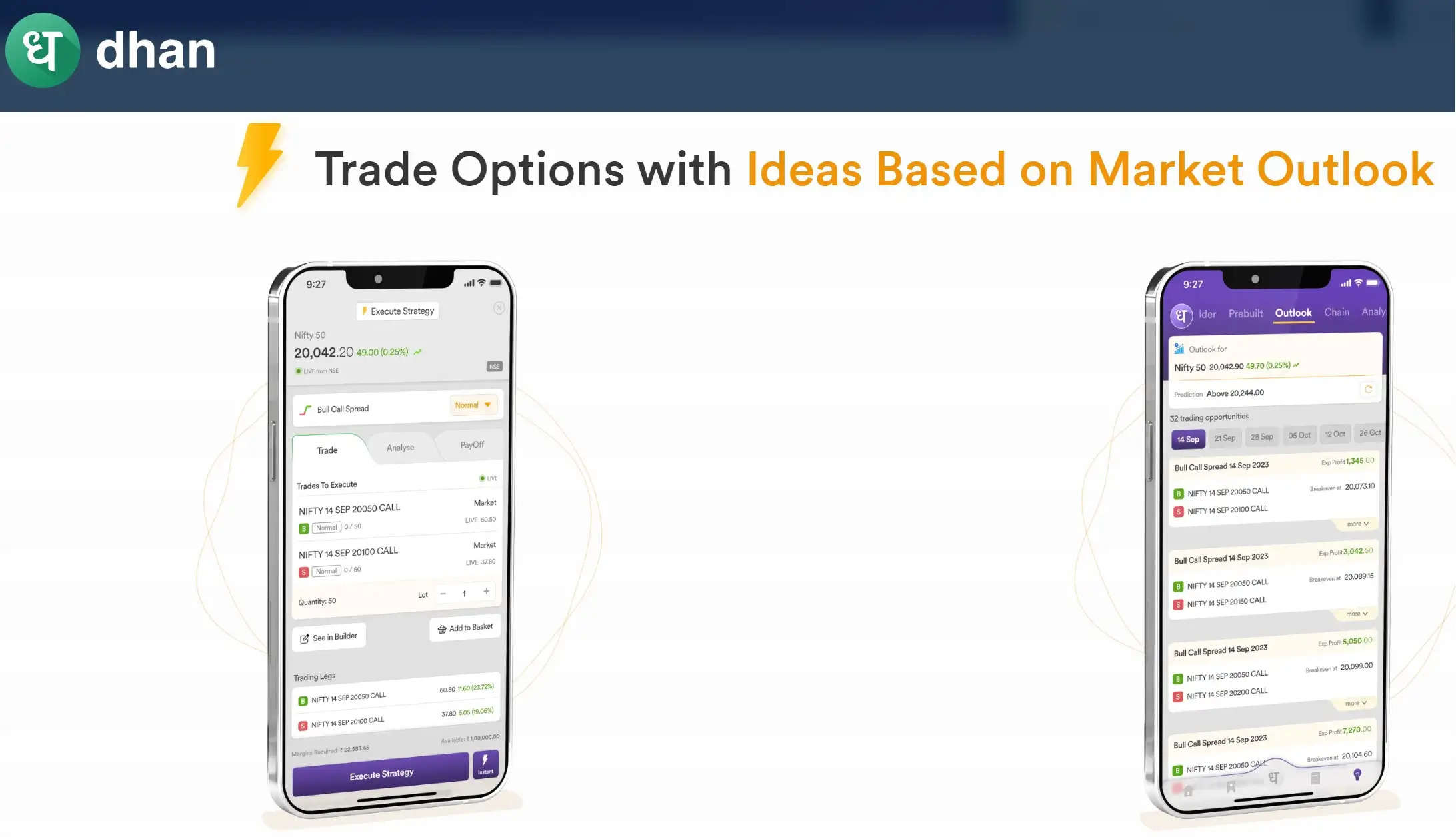

You can use the ‘pre-built option strategy’ feature which includes a bull call or iron condor and many more readymade strategies. You can directly implement these strategies in any option contract.

Along with that, you can use the feature called ‘outlook-based ideas’. This will help you select the option contracts based on a bearish, bullish, or neutral market view.

-

Select an Underlying Asset

The strike price of an option contract is dependent on the price of an underlying asset which can be a stock, index, commodity, or currency. In order to earn good profits, you can select an underlying asset that has shown great momentum in the last few days or months.

You can buy call or put based on the movement in the price of the underlying stock. Suppose the price of X Ltd. stock is rising or you are expecting it to rise, then you can buy call, or sell put. If the price of the stock is falling, then you can sell call, or buy put option.

-

Deploy Option Trading Strategies

You can choose from different option trading ideas to earn the maximum profits. In a bullish market, you can use a bull call spread strategy. In a bull call, you have to buy one at-the-money call option and sell one out-of-the-money call.

In the bull put spread, you have to buy one OTM put and sell one in-the-money put. In a bearish market, you can deploy a bear call spread wherein you have to buy 1 OTM call and sell 1 ITM call. In a bear put spread, you have to buy ITM put and sell OTM put.

Conclusion

In order to implement short-term trading ideas, you have to first select an option trading mobile app that is designed specifically for option traders. The next step is to select an underlying asset based on its bullish or bearish nature. After that, you can choose an options trading strategy like a bull call spread or bear put spread according to the market outlooks.

If you are looking for a derivative trading app that is safe and is offered by a registered stockbroker, then you can download the Dhan Options Trading App.

ADHERENCE TO GUIDELINES ON ONLINE ADVERTISING ISSUED BY ADVERTISING STANDARDS COUNCIL OF INDIA (ASCI)

This is a Collaborative Post published as provided and UdaipurTimes does not endorse any information provided in this post. This may involve an element of financial risk and may be addictive. Please act on your own accord.

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal