Cyber Fraud Part 6 - Fraud using Screen Sharing Apps/ Remote Access

Screen Sharing App horrors

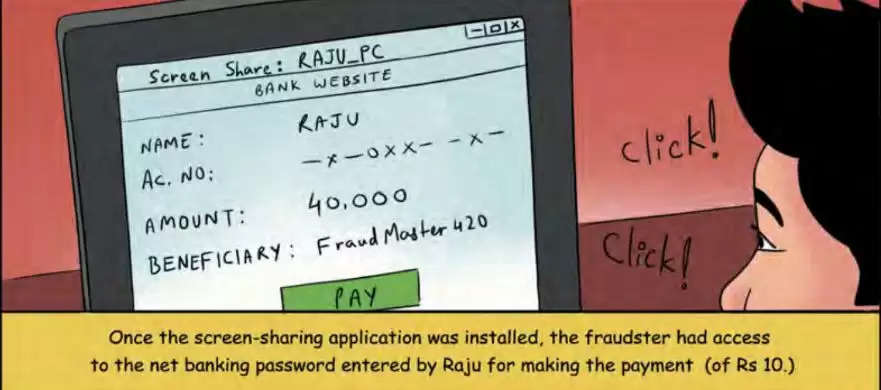

In today's society, technology is pervasive and obvious. Cybercrime is a regular occurrence in today's rapidly developing technological environment. We have access to a wide range of internet services in the modern world, including anything from online shopping to online payments. This article will focus on Screen-Sharing Fraud. In order to get remote access, hackers will act as bank or payment app employees or it can be from customer care service and persuade consumers to download a screen-sharing app. This practice is known as social engineering (phishing) fraud.

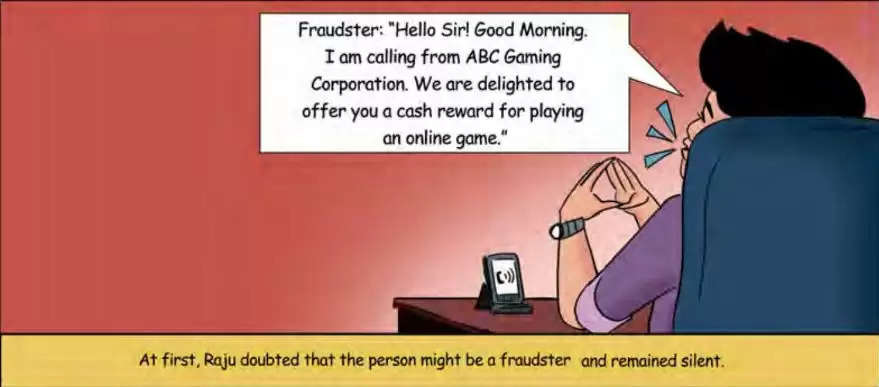

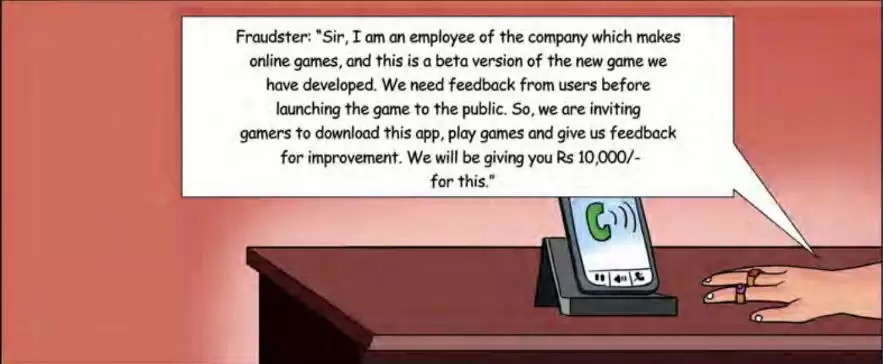

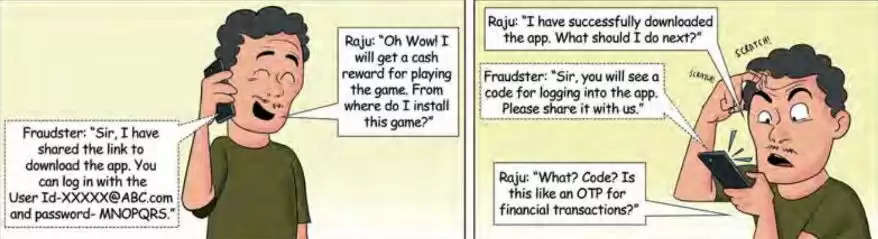

Any technique can be used to contact you by a fraudster. Fraudsters might call you directly, or send you messages on social networking sites. Be mindful of calls like these from fraudsters. Scammers want your money so they will gain your confidence as they have a variety of ways to defraud you. They occasionally make generous cash offers, but they can also lead you astray by telling you false things like your account might be blocked or that using these apps will benefit you etc.

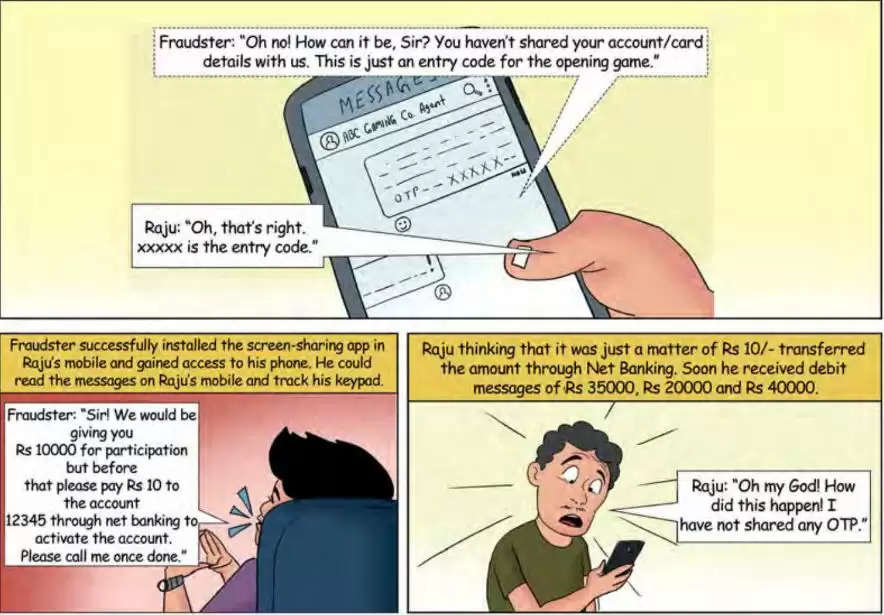

They will ask you to download a screen-sharing app and share a passcode in this kind of fraud, and once you enter the passcode, the scammer has access to your phone or computer. Once the fraudster gets remote access, he transfers money to his own account using the UPI payment software that is already installed on your phone. To complete the transaction, the fraudster requires an OTP or a QR code scanner. The fraudster keeps up the conversation with the victims. While doing this, scammers prevent them from viewing the bank alerts.

How to avoid this scam?

- Avoid clicking on messages and short links without first checking them.

- On your smartphone, install antivirus and spam-blocking software.

- Report the occurrence to the local cybercrime police station and the National Cybercrime Reporting Portal http://cybercrime.gov.in/

- Never download any software from links received over SMS, email, or instant messaging software.

- Downloading screen-sharing software from unknown sources is not recommended.

- They are scammers if they remotely control your smartphone and ask you to enter into your bank account, provide personal information, or unlock your payment applications.

- Never download applications while on the phone.

- Avoid making purchases while on call.

- On smartphones, every app should have password protection.

- Never share QR codes or share OTP with anybody. OTP sharing and scanning QR codes result in a financial transaction that debits your account.

Sources: Click Here

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal