Cyber Fraud Part 17 - Fraudulent Loans With Stolen Documents

Beware of loan frauds

There is no denying that our digital economy has exploded in the last sevNowadays, everything is available online, whether it's making a payment or purchasing anything. There are other drawbacks, such as the growing possibility of cybercrime. This article will concentrate on fraudulent loans with stolen documents. Nowadays, everything is available online, whether it's making a payment or purchasing anything. There are other drawbacks, such as the growing possibility of cybercrime. This article will concentrate on Fraudulent Loans With Stolen Documents.

How A Fraudster Cheats You With This Technique?

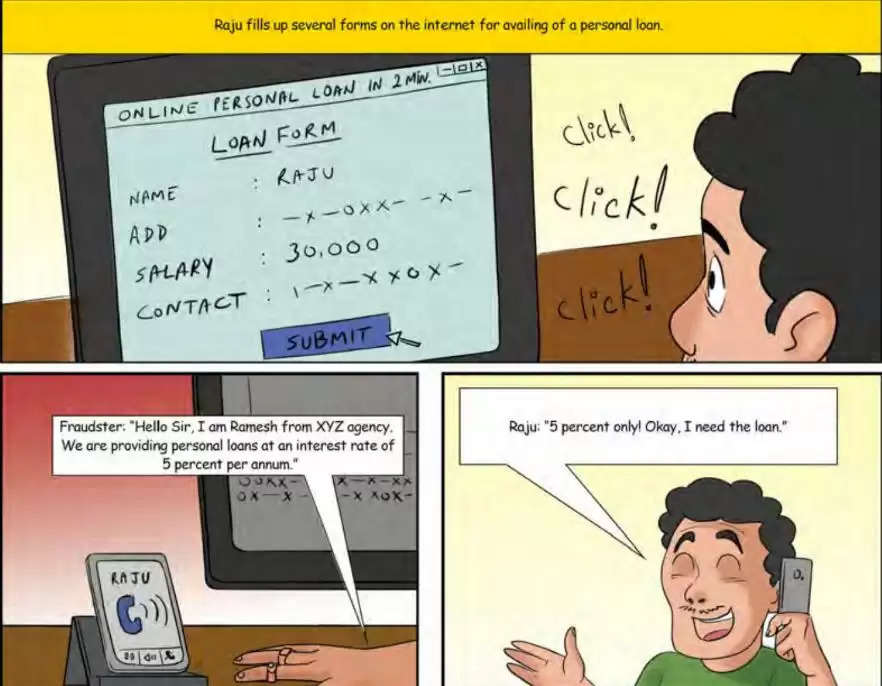

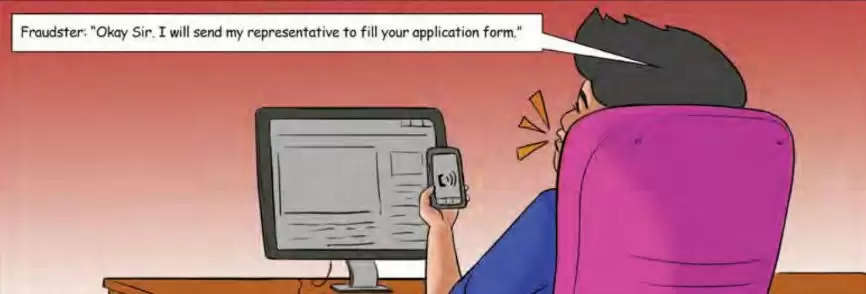

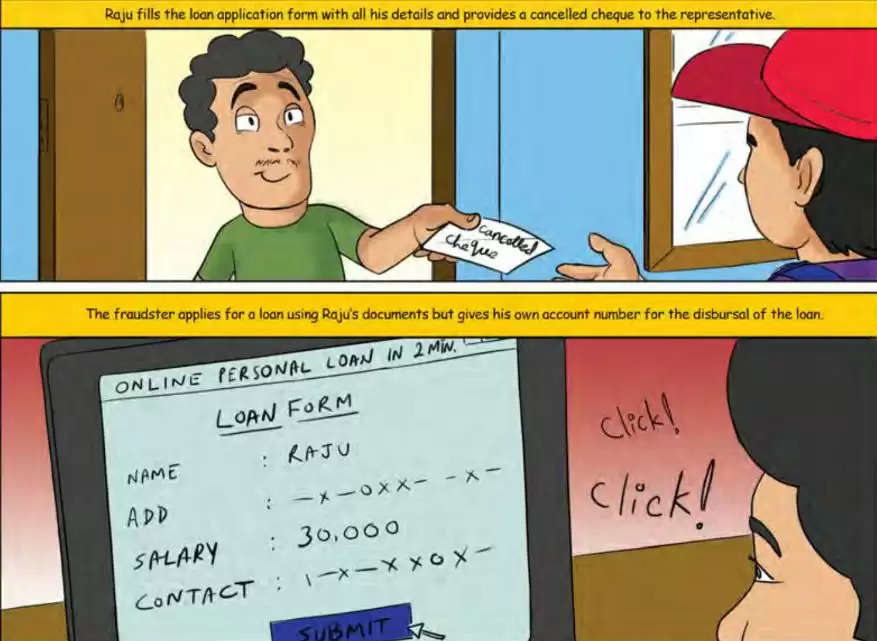

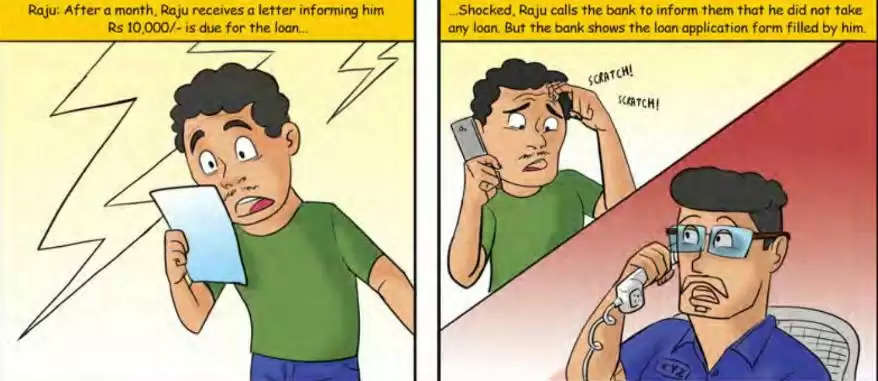

Ghost loans are loans taken out by fraudsters who use stolen identities and have no intention of repaying them. Let's take a look at how they might be obtained in your name by using stolen credentials.

A standard KYC procedure looks for three items to verify your credentials: proof of identification (POI), proof of address (POA), and picture evidence. Lenders ask you to produce your PAN Card as evidence of identity. This is to ensure that you are who you say you are. Assume that fraudsters obtain a duplicate of your PAN card. They then use powerful software programmes to replace your photo on the PAN with their own.

When the verification procedure is mainly manual, these skilfully manipulated documents often go unnoticed. Similarly, fraudsters tamper with the photo on proof of address documents like your Aadhaar card or driver's license.

A picture ID is required to show that the individual asking for the loan is the same person whose documents are being presented. After tampering with POI (point of location) and POA (legal authority to act on your behalf) papers, fraudsters gladly submit their own image as part of this final stage.

How To Avoid This Scam?

- Never share your confidential details like Aadhaar Card, PAN number, cheque book or cheques with unknown person.

- Report the occurrence to the local cybercrime police station and the National Cybercrime Reporting http://cybercrime.gov.in/

Sources: Click Here

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal