Income Tax Department provides solutions for Aadhaar-PAN linking failures due to Name, DOB, Gender Mismatch

Here are the details

If you encounter a failure in linking your Aadhaar and PAN due to a mismatch in your name, date of birth (DOB), or gender, there are steps you can take to resolve the issue. The Income Tax Department has provided guidelines on how to address this problem. Here are the details:

The deadline for linking Aadhaar and PAN is approaching, and PAN holders who have not completed the linking process can do so until June 30. However, there is a fee of Rs 1000 associated with linking after the original deadline. It's important to note that failure to link Aadhaar and PAN by the end of this month will render the affected Permanent Account Numbers (PAN) invalid starting from July 1, 2023.

PAN holders have been expressing concerns about their inability to link PAN-Aadhaar due to demographic discrepancies, including differences in name, date of birth, and gender between their PAN and Aadhaar cards. Addressing this issue, the Income Tax Department recently provided guidance on the steps that these PAN holders can take to resolve the problem.

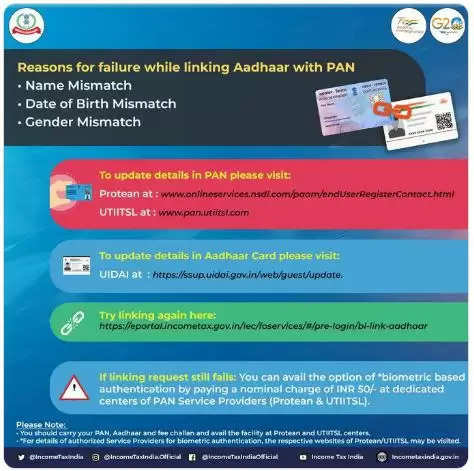

If there is a demographic mismatch between your PAN and Aadhaar, the Income Tax Department has suggested utilizing biometric-based authentication at dedicated centers of PAN Service Providers (such as Protean and UTIITSL). By visiting these centers, individuals can avail themselves of the biometric authentication process to address the demographic discrepancies and facilitate the linking of PAN and Aadhaar.

“Kind Attention PAN holders! While linking PAN with Aadhaar, demographic mismatch may occur due to mismatch in: Name, Date of Birth, Gender. To further facilitate smooth linking of PAN & Aadhaar, in case of any demographic mismatch, biometric-based authentication has been provided and can be availed of at dedicated centers of PAN Service Providers (Protean & UTIITSL),” the Income Tax department tweeted.

You can update PAN details by visiting:

- Protean at: www/onlineservices.nsdl.com/paam/endUserRegisterContact.html

- UTIITSL at: http://www.pan.utiitsl.com

You can update your Aadhaar details by visiting the UIDAI website at: https://ssup.uidai.gov.in/web/guest/update

After the demographic mismatch is resolved, users can try linking PAN-Aadhaar at the e-filing portal – https://eportal.incometax.gov.in/iec/foservices/#/pre-login/bl-link-aadhaar.

If the process of linking PAN and Aadhaar continues to fail, what steps can be taken to address the issue?

According to the Income Tax Department, if the attempt to link PAN and Aadhaar fails, individuals have the option to opt for biometric-based authentication by visiting dedicated centers of PAN Service Providers (such as Protean and UTIITSL). To avail of this option, a nominal charge of Rs 50 needs to be paid at these centers.

To avail biometric authentication at Protean and UTIITSL centers, individuals should ensure they carry their PAN and Aadhaar documents with them. For detailed information on authorized service providers offering biometric authentication, you can visit the official websites of Protean and UTIITSL. These websites will provide you with the necessary details regarding the process and requirements for biometric authentication.

Source: Financial Express

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal