Know the Reasons and Background - UFBU Nationwide Bank Strike 16-17 December

- The two day strike will result in a 4 day shutdown as the strike is followed by weekend.

- Strike has been called by United Forum of Bank Unions (UFBU).

- UFBU represents nearly one million employees of Public Sector Banks.

- UFBU is an umbrella body of nine unions.

The United Forum of public Bank employee unions (UFBU), representing nearly a million employees and officers of the public sector banks in India have called a nationwide strike which will be spread over 2 days, viz. 16 and 17 December.

Protesting against the Banking Laws (Amendment) Act 2021, the United Forum of Bank Unions (UFBU) is demanding that the Banking Laws Amendment Bill is not tabled during the session of the Parliament. Instead it asks for strengthening of the public sector banking institutions rather than privatization of public sector banks. In the 2021 Budget, the Government had informed of its decision to privatise two Public Sector Banks in addition to IDBI Bank.

Why the agitation/strike?

A Brief History

Since the liberalization policies took effect in India since the late nineties, the public sector banks have been weakened through divestment and privatization.

After 1947, the Banks, which were in private hands, did not come forward for economic development in an inclusive manner. Small industries, agriculture sector, rural and cottage industries, which were the mainstay of the economy, remained neglected. The nationalization of the Banks hence was adopted to give an impetus to the nation’s growth and eventual progress.

The first bank to be nationalized was The Imperial Bank of India, which was converted to State Bank of India and 7 banks of princely states were nationalized and became associate Banks of SBI. The count of Nationalised Banks were further augmented by nationalizing 14 banks in 1969 and 6 more in 1980. The SBI, its associate banks and the other nationalized Banks now became the foundation for the inclusive national development. Reaching out to remote areas and the common masses, this nationalization ensured the inclusive development of the neglected areas as these became the priority areas of the nationalized banks. Class Banking became Mass Banking and the common man got access to convenient and safe banking. Growth of the Nationalised Banks in the country since the first initiative that gave birth to the State Bank of India and the subsequent 5 decades is demonstrated by the following numbers:

| Nationalised Banks | 1969 | 2021 |

| Total Branches | 8,000 | 1,18,000 |

| Total Deposits | 5,000 Cr. | 157 Lakh Cr. |

| Total Advances | 3,500 Cr. | 110 Lakh Cr, |

The contribution of Nationalised Banks:

- PSB's are the vehicle for growth and development.

- Emancipated farmers and rural folk from clutches of money lenders.

- PSB's are trustees of savings and repository of public confidence.

- PSB's reservoirs to irrigate economic development of the country.

- PSBs' made the country self sufficient.

- Played a pivotal role in revolutions.

- Today's inclusiveness, agriculture growth, strength and prosperity is the result of Nationalisation of Banks.

Mis-conception on Profitability and Efficiency of Public Sector Banks

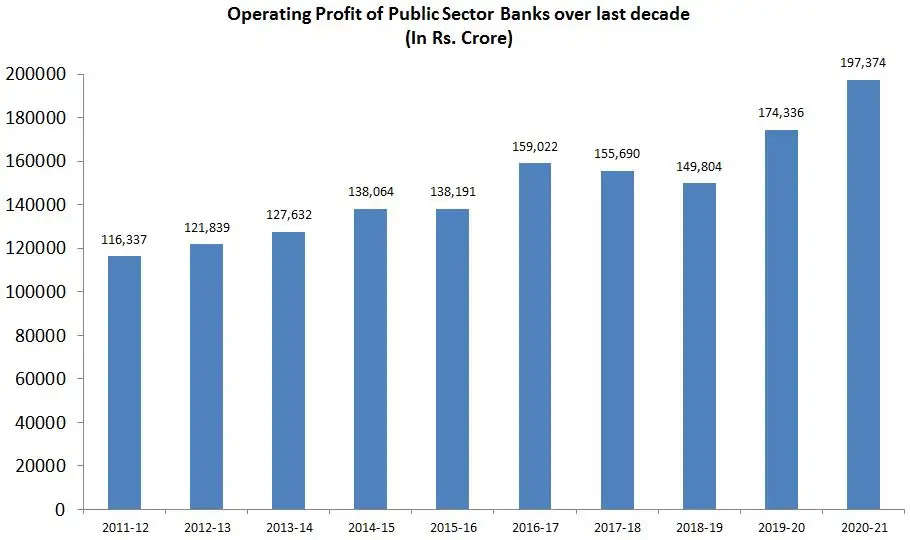

As per the data provided by the United Forum, Public Sector Banks are earning huge profits as against the preconceived notion that they are not. Check the image below for operating profit figures of the last decade:

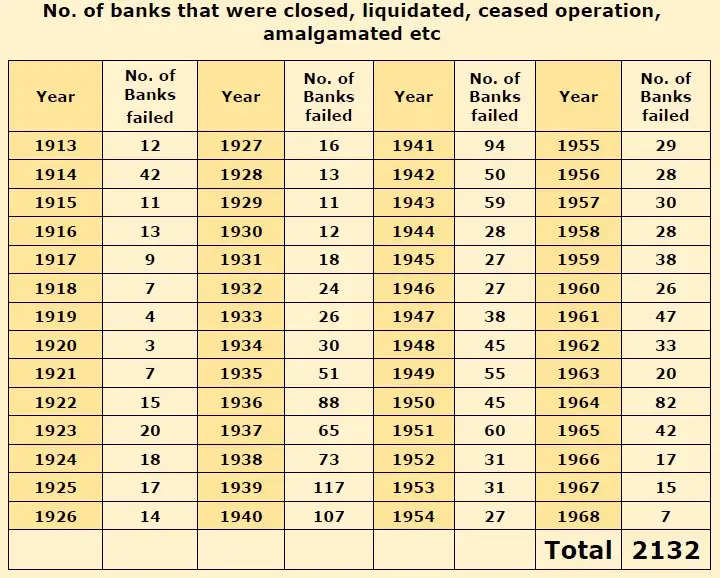

Additionally, they are of the opinion that privatisation neither brings efficiency nor safety. Innumerable private banks across the world have failed and it is the public sector banks that have bailed them out. If Private Banks are an epitome of efficiency, then NPA levels would have been much lower, and so many of the private banks would not fail.

Private Banks Failed or Bailed Out after 1969

The Concern and the Demand

As per the United Forum weakening our public sector banks is unwarranted, unjustified and is a regressive step. Instead of further strengthening public sector banking, the present policies are aimed to weaken PSBs, by starving them of the required capital, human resources, allowing private hands through disinvestment and proposed privatisation moves. The United Forum of Bank Unions demand strengthening of Public Sector Banks, by adequate infusion of capital, human resources and strengthened statutory framework to recover the stressed assets. It is mischievous according to the Forum, that the huge network of branches of Public Sector Banks as well as Assets be transferred to private hands. This will be like turning the clock back for a country like India, taking the mass banking back to class banking.

The United Forum in its statement has opposed the retrograde banking reforms initiated three decades ago. The various committees formed by the government, as per the United Forum, are speaking the governments language as in proposing privatization instead of strengthening the public sector banking system. Irrational policies that encourage private sector banks, allowing licenses to small banks and payments to private corporate and laying the blame on the public sector banking institutions for the alarming NPAs and showing them in poor light clearly exhibits bias in favor of radical discrimination.

The Gross NPA of Private Banks was Rs 47,300 Crore in 1997 and is Rs. 6,16,015 Crore in 2021. The Gross NPA settled by writing of defaulters loans of Rs 68,607 Crores. In the garb of NPA Resolution, laws like Insolvency and Bankruptcy Code have forced hair-cuts upon PSBs. As per the latest numbers on settlement and hair cut provided by the United Forum, the total loan due in 13 such accounts was Rs. 4,46,800 Crore, of which Rs 1,61,820 Crore was resolved and settled for. This amounted to a hair cuit of 64% and the total loss to the Banks was Rs. 2,84,980 Crores. The main people behind the bad loans that are haunting the banks today are corporate and wilful defaulters. Of the total operating Profit in 13 years of Rs 15,97,458 Crores, the Provisions for Bad Loans have been Rs 14,42,001 Crore. The urgent need for considering NPA recovery norms and tightening procedures and marking wilful defaulters as Criminals can alone deter such wilful default.

The first time the Bank unions came out in unision was in March 2021, after the government announced in February 2021 that two public sector banks would be privatised. That protest was ignored and now the government is coming up with the Privatisation Bill and now that all reasonable avenues are exhausted, this strike is necessary to draw attention, says the UBFU.

Data and information source: UBFU

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal