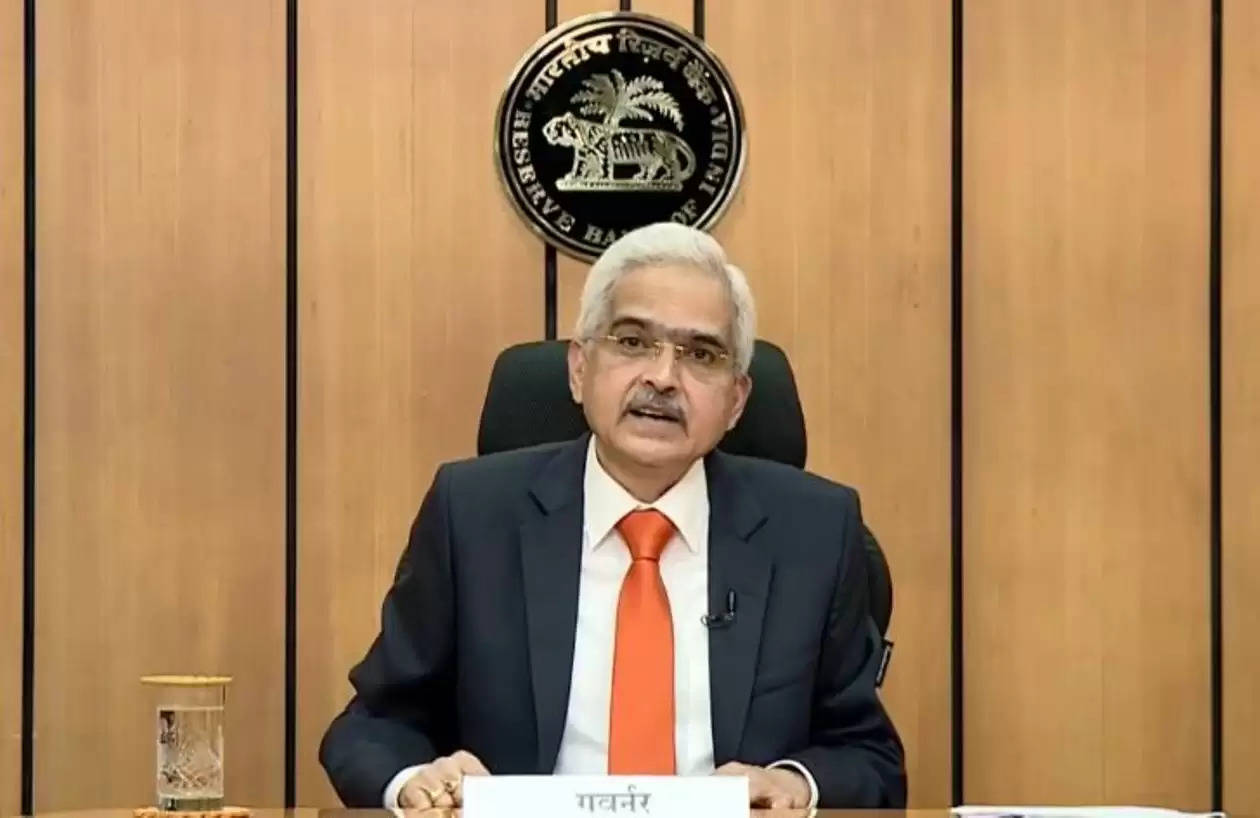

RBI Chief Shaktikanta Das Honored with Governor of the Year Award at Central Banking Awards 2023

On June 14, Shaktikanta Das, the Governor of the Reserve Bank of India (RBI), was honored with the prestigious Governor of the Year award at the Central Banking Awards 2023 held in London. The esteemed recognition was bestowed upon him for his exceptional leadership qualities and adept management of various crises that emerged during his tenure as the RBI governor.

Shaktikanta Das took office in December 2018, amidst a critical juncture for India's financial sector and navigating the challenges posed by the initial and subsequent waves of the coronavirus pandemic, his tenure as RBI governor has been instrumental. During his leadership, Das successfully managed the resolution of numerous distressed non-bank financial companies, fostering stability in the sector. Furthermore, his diligent efforts contributed to the gradual enhancement of the banking sector, which had previously acted as a hindrance to the country's economic growth.

Before Shaktikanta Das assumed office, in August 2018, the bankruptcy of IL&FS, a major non-banking financial company (NBFC), sent shockwaves through the financial sector. This event not only resulted in a liquidity crunch but also exposed vulnerabilities in the business models of several mid-sized banks that had extended substantial loans to NBFCs.

Following IL&FS's bankruptcy, the financial landscape witnessed the collapse of other notable entities, including Punjab and Maharashtra Co-operative Bank. Prior to Shaktikanta Das's appointment, his predecessors, Raghuram Rajan and Urjit Patel, had already undertaken certain measures to tackle the crisis in the non-banking financial sector. These initiatives involved revising the bankruptcy code to facilitate the resolution of distressed NBFCs. However, during Das's tenure as RBI governor, further measures were implemented to address the ongoing challenges, ensuring a more comprehensive response to the crisis.

As part of the efforts to address the non-banking financial crisis, Shaktikanta Das's tenure as RBI governor witnessed the implementation of crucial measures. These included the introduction of liquidity regulations specifically designed for non-banking financial companies (NBFCs) and enhanced supervision of key entities operating within the sector. In October 2022, a significant milestone was reached with the introduction of a new scale-based regulatory framework exclusively tailored for NBFCs. These measures aimed to ensure a more robust regulatory framework and effective oversight of the NBFC sector.

Amongst the various challenges faced by the banking sector, public sector banks (PSBs) have encountered particularly significant hurdles, such as elevated levels of non-performing assets (NPAs), inadequate capitalization, and limited lending growth. Nonetheless, since 2018, there has been a noticeable and consistent upturn in the banking sector's performance, which had appeared to be in a precarious state during that period. The concerted efforts and measures implemented during this time have contributed to the gradual enhancement and recovery of the banking sector's overall health and resilience.

Shaktikanta Das has effectively overseen the response to two major crises during his tenure: the COVID-19 pandemic and its subsequent economic repercussions, as well as Russia's invasion of Ukraine and the resulting inflationary impact. Despite the formidable challenges posed by these events, India has emerged as the fastest-growing major economy globally. Moreover, under Das's leadership, significant progress has been made in reducing poverty levels, reflecting the country's commendable strides towards socio-economic development.

Source: Click Here

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal