PAN-Aadhaar link fee challan: Income Tax Department resolves payment confusion

Providing clarity and relief to payers

The Income Tax Department has announced that it will duly consider cases where fee payment and consent for linking have been received, but the actual linking of accounts has not been completed by June 30, 2023. PAN, a distinct identification number provided to individuals and businesses for taxation purposes, differs from Aadhaar, which is assigned to all residents. To streamline financial transactions, the income tax department has implemented a mandatory requirement of linking PAN and Aadhaar cards.

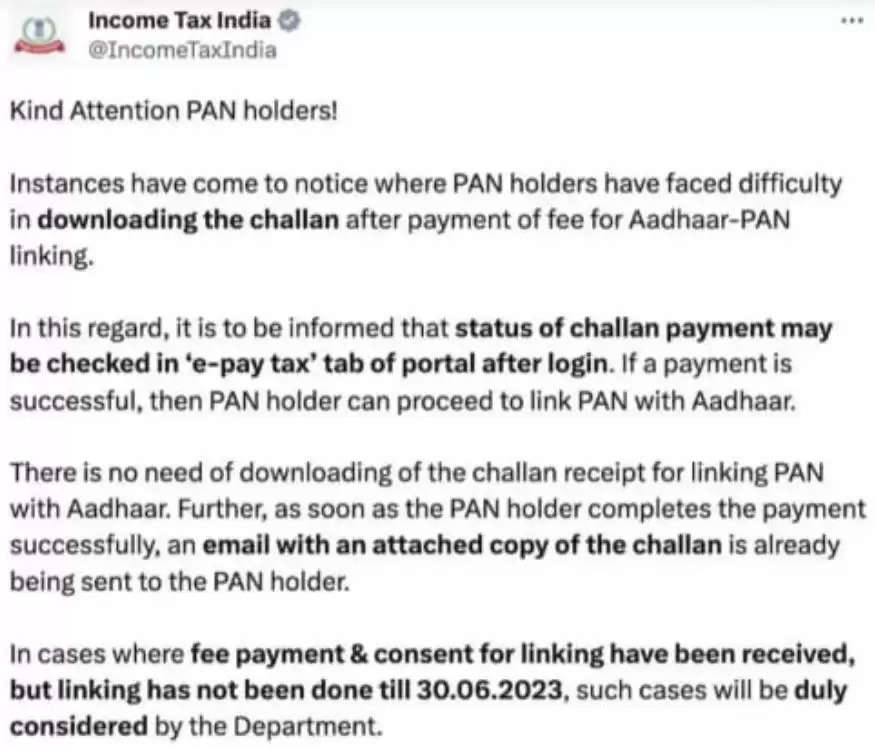

Several individuals have encountered challenges when attempting to download the challan after completing the fee payment for Aadhaar-PAN linking. Furthermore, issues have arisen due to mismatches in name, date of birth (DOB), or gender during the Aadhaar-PAN linking process. To address these concerns, the Income Tax Department has issued comprehensive guidelines on how to resolve such problems.

This problem is causing an obstacle for many. The Central Board of Direct Taxes (CBDT) has a solution available to resolve this issue. In its official Twitter handle, the income tax department clarified, in cases where fee payment and consent for linking have been received, but linking has not been done till 30 June 2023, the Department will duly consider such cases.

The clarification regarding the process of downloading challan receipts has been provided shortly before the deadline for linking PAN with Aadhaar expires. The income tax department has implemented the mandatory requirement of linking PAN and Aadhaar cards to facilitate smoother financial transactions.

Steps to Link Aadhaar with PAN:

- Visit the Income Tax Department’s website.

- Tap on the ‘LINK Aadhaar’ option under the ‘Quick Links’ sections.

- Enter Aadhaar, PAN number as per the given fields.

- Check the box that reads ‘I agree to validate my Aadhaar details with UIDAI.

- Enter Captcha code.

- Click ‘Link Aadhaar Button.’

- A confirmation message will appear declaring that your linking has been successful.

- Continue by clicking e-Pay Tax. Post OTP verification, you will be redirected to e-Pay Tax page (If you have linked after the deadline).

- After paying a late fee of Rs. 1,000, download your challan.

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal