Explained-What is the Multi State Vehicle Registration Series

Vehicles under new series BH will not require to be re-registered after changing state.

The scheme is, however, voluntary.

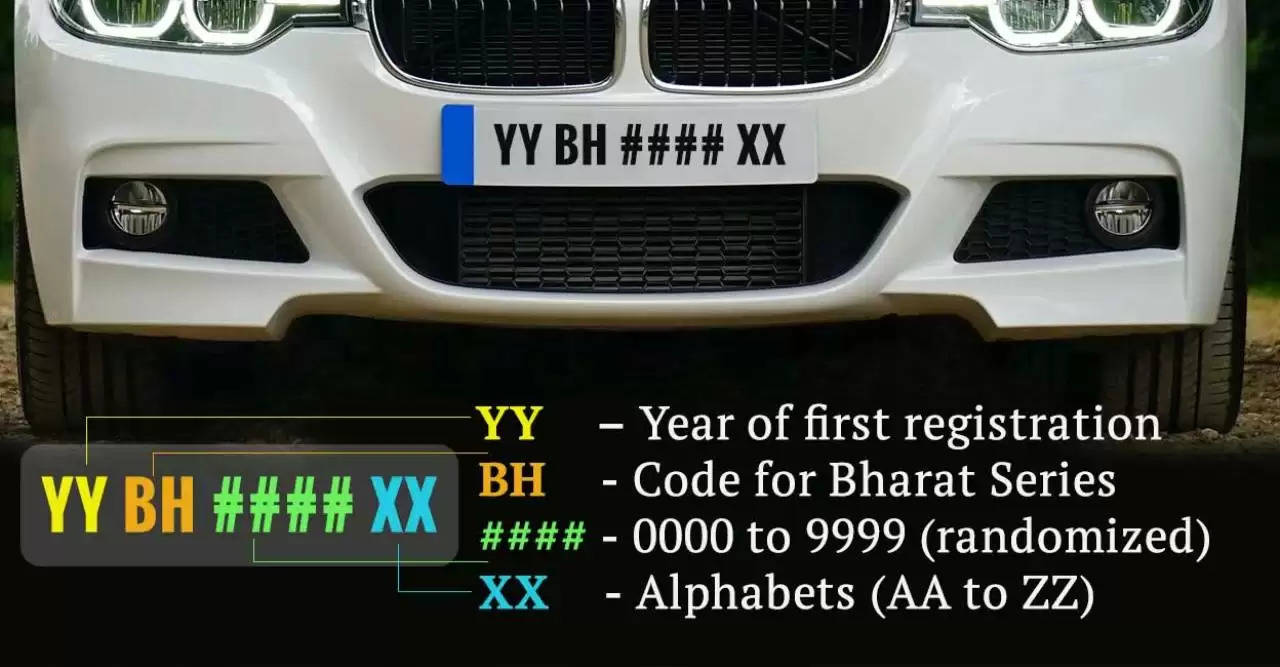

A new registration series has been introduced by the Ministry of Road Transport for hassle free transfer of private vehicles in different states. The new series begins with “BH” which stands for Bharat.

Personal vehicles owned by defence personnel, employees of Central and State governments, PSUs and private sector companies and organizations having offices in 4 or more states and union territories will be registered under this new series.The scheme is, however, voluntary.

The new series of registration will make transfer of vehicle from one state to another hassle free as there are many employees who frequently get transferred and need to take their personal vehicles to other states. As per the present rules, a person is allowed to continue with other-state vehicle for a period of 12 months after which it needs to be re-registered.

Vehicles under BH registration will not require being re-registered once the owner is transferred to another state. BH series owners will have to pay the road tax for 2 years or in multiple of 2. The complete process will be done online to ensure that the person does not make rounds of the RTOs.

Earlier IN series was proposed but was replaced with BH. Currently, while registering private vehicles, the owners need to pay the 15 years’ road tax upfront. If they transfer their vehicles to any other state and go for re-registration they need to pay the road tax for the remaining years such as 10 or 12 years. Then they need to claim the already paid amount from the state where the vehicle was originally registered. The new regime aims to put an end to this problem.

In the BH series, the road tax has been fixed at 8 % for vehicles costing upto Rs 10 lakhs, 10% for vehicles costing between 10 to 20 lakhs, and 12% for vehicles costing over 20 lakh rupees. 2% extra charge for diesel vehicles and 2% less for electric vehicles. The motor vehicle tax or road tax will be levied for two years or in multiple of two. After completion of the fourteenth year, the motor vehicle tax shall be levied annually which shall be half of the amount which was charged earlier for that vehicle.

(source/inputs:toi)

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal