Tere paas Gaadi hai, Bangla hai... mere paas FASTTag hai | All you need to know about FAST TAG

FASTags become mandatory from 15 Jan 2020

Any vehicle crossing with out FASTag or FASTag balance will need to pay double the amount in cash

In order to ease traffic congestion on highways, the National Highways Authority of India has implemented the FASTag lanes mandatorily from 15 January 2020. The process is managed through the Electronic Toll Collection mechanism, which is a collection of RFID scanners, peripheral hardware and software that runs on cloud computing.

Accordingly, FASTags are mandatory on all vehicles operating on the highways. Vehicles moving across toll plaza and with FASTags on their vehicle, will pass through smoothly as the amount will be deducted automatically from from

However, users need to be aware of certain specific norms and directions towards the use of FASTags.

- FASTags are mandatory from 15 Jan 2020.

- FASTags are prepaid rechargeable tags that are affixed to the window shield of your vehicles (similar to RFID stickers).

- Vehicles moving across toll plaza and with FASTags on their vehicle, will pass through smoothly as the amount will be deducted automatically from the FASTag balance.

- One hybrid Lane on all Toll across all highways through the country will be “Hybrid Lanes” that will accepts other modes of payment apart from FASTag. This lane will cater to oversized vehicles. This Lane will also be phased out eventually.

- Any vehicle crossing with out FASTag or FASTag balance will need to pay double the amount in cash.

- One FASTag cannot be used on more than one vehicle.

- Most vehicles that have been sold since 2017 come equipped with FASTag.

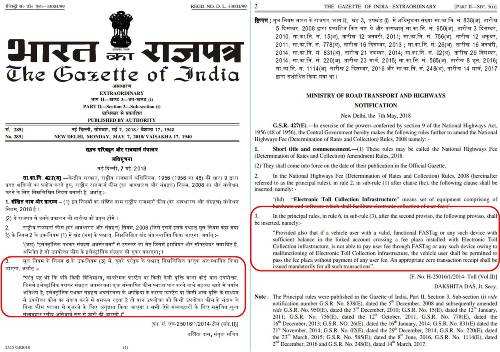

- As per a government Gazette notification, IF the FASTag infra at any Toll plaza fails to identify a valid (charged) FASTag or malfunctions, the vehicle will be allowed to pass WITHOUT any payment. THIS IS AN IMPORTANT notification and users need not pay any cash at such a Toll. DO NOT BE COERCED into paying cash. Download and retain the following Gazette Notification in case of any arguments at such Tolls.

Exempted Toll Plazas

Select Toll plazas across the country, having high cash transactions have been identified to allow upto 25% hybrid lanes that will accept both online and cash transactions. This was announced after the NHAI, while implementing the ETC program, raised concerns regarding high cash transactions at 65 identified toll plazas across the country. NHAI has implemented ETC at 535 toll plazas across the country. As per the Highways Ministry notification, NHAI must ensure that 75% lanes across the selected 65 toll plazas allow for FASTag vehicle movement.

How to buy FASTag

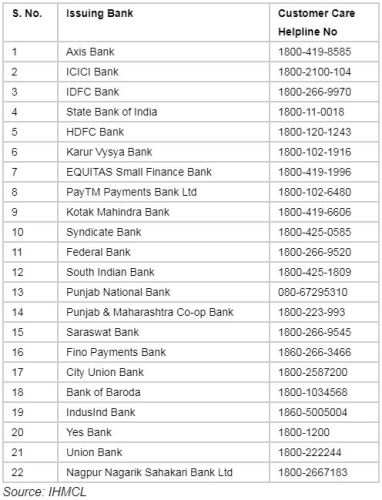

FASTag can be procured online from HDFC, Axis, ICICI, Kotak, PayTM, Airtel, Amazon and such platforms. 22 banks are authorized to issue FASTags through point of sale (PoS) counters. The vehicle owner needs to fulfill KYC by uploading the vehicle documents, vehicle registration number. A license upload is enough to complete the ID and address requirements. Petrol Pumps across the country are also equipped to sell FASTags.

a) Self-Activation: FASTag can be self activated using the My FASTag moble app available on Google Play Store and Apple Store. FASTag is a bank neutral concept and can be self activated. You can link your FASTag to any of your bank accounts. Alternatively you may also use the NHAI Prepaid Wallet to process charge and deduction of FASTag balances.

b) Activate by visiting certified bank branch: You can also buy FASTag by visiting the nearest certified bank branch and get the FASTag linked with your existing bank account.

What are the Charges for FASTag

NPCI (National Payments Corporation of India) has defined Rs 100 as the maximum a seller can charge for the FASTag. Banks and online sellers are adding certain amounts like handling charges, delivery charges, basic recharge, security deposit, etc. which is permissible for the service given. Top Up Charges may differ from Bank to Bank.

For eg. ICIC is charging Rs 499.12, the breakup for which is: Rs. 99.12 for Tag issuance; Rs. 200 for Refundable Security Deposit; rs. 200 for first Recharge amount in wallet. Similarly, HDFC charges Rs 400 for Car, which includes Rs. 100 for Tag issuance; Rs 200 for Security Deposit and Rs 100 for first Recharge. FASTags are expensive if bought from Online platforms.

What are the Charges for FASTag

A FASTag, is linked to a Bank account, need not have to recharge, if the user ensures availability of balance in the Bank account. Charges will be deducted automatically. However, if the FASTag is linked to a wallet, then a recharge of Wallet can be done through regular channels such as Credit Card, Net Banking, UPI, Debit Card, etc. There, however, is a limit to the mazimum balance that can be kept in the FASTag account. The limits are as follows:

For full KYC FASTag account holder: This type of FASTag account cannot have more than Rs 1 lakh in their FASTag prepaid wallet. There is no monthly reload cap in this account, according to the Indian Highways Management Company Limited (IHMCL) website.

For limited KYC FASTag account holder: This type of FASTag cannot have more than Rs 20,000 in their FASTag prepaid wallet. The monthly reload limit is also capped at Rs 20000.

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal