Hindustan Zinc EBITDA up 18% y-o-y in Q3 and 46% YTD

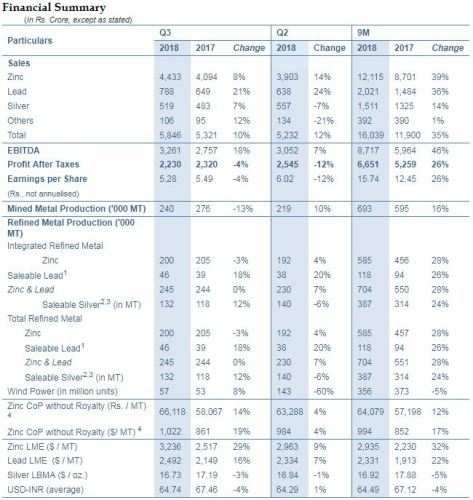

Hindustan Zinc Ltd has achieved an EBITDA of Rs. 3,261 crore in the third quarter ended 31 December 2017 as compared to the third quarter ended 31 December 2016 EBITDA of Rs 2,757 crore, garnering an increase of 18% in year-on-year growth for the zinc-silver metal global giant

Hindustan Zinc Ltd has achieved an EBITDA of Rs. 3,261 crore in the third quarter ended 31 December 2017 as compared to the third quarter ended 31 December 2016 EBITDA of Rs 2,757 crore, garnering an increase of 18% in year-on-year growth for the zinc-silver metal global giant.

The increase was attributed to firm metal prices along with a substantial increase in underground mine production, as per the report. Year to date growth achieved was 46%, i.e. Rs. 8,717 crore for nine months ending 31 Dec 2017 as compared to Rs. 5,964 crore for nine months ending 31 December 2017.

“I am pleased to report that underground mines contributed to 85% of total production during the year so far, underpinning our successful transition to a fully underground mining company. In the six years of our transformational journey, we have consistently delivered higher production, profitability & record dividends, supported by increasing metal prices. The target of 1.2 million MT of mined metal production is now within our reach.”

Agnivesh Agarwal, Chairman

Highlights for the quarter

- Mined metal production at 240kt, up 10% q-o-q and down 13% y-o-y

- Refined zinc-lead metal production at 245kt, up 7% q-o-q and flat y-o-y

- Refined silver production at 132 MT, down 6% q-o-q and up 12% y-o-y

- EBITDA at Rs. 3,261 Crore; up 7% q-o-q and 18% y-o-y

Highlights for 9M

- Mined metal production at 693kt, up 16% y-o-y

- Refined zinc-lead metal production at 704kt, up 28% y-o-y

- Refined silver production at 387 MT, up 24% y-o-y

- EBITDA at Rs. 8,717 Crore; up 46% y-o-y

Financial Performance

- Rs. 5846 Crore Revenue – an increase of 12% on q-o-q and 10% y-o-y

- EBITDA – Rs. 3261 crore – up 18% y-o-y and 7% q-o-q

- YTD EBITDA increased by 46% y-o-y to Rs. 8717 crore

- PAT – 2230 crore, down 4% y-o-y and 12% q-o-q

Operational Performance

- Zinc metal Production : 20,000 tonnes -4% higher sequentially and 3% lower Y-o-Y

- Lead metal Production : 46,000 tonnes – 20% higher q-o-q and 18% higher y-o-y

- YTD EBITDA increased by 46% y-o-y to Rs. 8717 crore

- Silver production : 132 tonnes – 6% lower q-o-q on accumulation of WIP and up 12% in line with higher lead production

Net profit during the quarter was at Rs. 2,230 Crore, down 4% y-o-y and 12% q-o-q while for YTD net profit was up by 26% y-o-y to Rs. 6,651 Crore. Lower investment income on account of smaller corpus and lower rate of return and higher depreciation & tax rate partly offset gains in EBITDA. Excluding a one-time exceptional gain of Rs. 291 Crore in Q2 related to the Supreme Court’s favourable judgement on District Mineral Fund levies, net profit during the quarter was at similar level as compared last quarter.

As announced last quarter, the Company has done forward sale of 220kt of zinc and 30kt of lead at $3,084 and $2,418 respectively for the period January to June 2018. Of this, 165kt (150kt of zinc and 15kt of lead) is for Q4 FY 2018 and remaining from April to June 2018. There were no further forward sales during the quarter.

Outlook

Production guidance for FY 2018 is reiterated with mined metal to be higher than FY 2017, refined zinc-lead metal of about 950kt, refined silver metal of over 500 MT. Zinc COP for FY 2018 is projected to be in the range of $950 to $975 per MT due to continued increase in commodity prices offsetting benefit of higher volume and cost efficiency measures. The Company is on track to achieve 1.2 million MT per annum (mtpa) mined metal production capacity by FY 2020.

Expansion Projects

Capital mine development increased by 55% y-o-y and was flat q-o-q to 9,685 meters during the quarter across all mines. For the nine-month period, capital mine development was 28,126 meters, up 69% as compared to corresponding prior period.

Rampura Agucha underground mine achieved the highest ever mine development for the quarter at 5,958 meters, 11% higher than the previous best. The underground mine has crossed ore production run rate of 2.0 mtpa. The main shaft hoisting system was commissioned during the quarter and is now in operation for waste hoisting. South primary ventilation system is progressing on fast track and expected to commission by end of January 2018. Off shaft development is on track and production from the shaft is expected to start as per schedule from Q3 FY2019.

Sindesar Khurd mine achieved mine development of 4,527 meters during the quarter. It crossed 4.5 mtpa run-rate for ore production during the quarter. Main shaft equipping is progressing as per schedule and on track for completion in Q4 FY2018, with production from the shaft expected to start as per schedule in Q3 FY2019. Civil and structure erection for the new 1.5 mtpa mill is going on at full swing and expected to commission in Q2 FY 2019.

Zawar mine achieved mine development of 6,555 meters during the quarter. Post completion of the Zawar mill debottlenecking to 2.7 mtpa, detailed engineering and site construction work for the new mill of 2.0 mtpa has commenced. The new mill is expected to commission in Q3 FY 2019.

Kayad and Rajpura Dariba: The Expert Appraisal Committee of MoEF has approved expansion of ore production at Rajpura Dariba from 0.9 to 1.08 mtpa and at Kayad from 1.0 to 1.2 mtpa. This will pave the way for higher production from these mines in the near future.

Fumer project at Chanderiya is progressing as per schedule. Civil construction work is 70% complete and the project is on track to get commissioned by mid-FY 2019.

Liquidity and investment

As on December 31, 2017, the Company’s cash and cash equivalents was Rs. 19,176 Crore invested in high quality debt instruments. During the quarter, the Company paid off the remaining Rs. 593 Crore of short term commercial paper, which was raised in March 2017 to meet the special interim dividend funding requirement.

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal