Nifty 50 delivers 10.51% Annual Return; Metals, Auto Outperform – Motilal Oswal Mutual Fund

Metals gained 8.5% during the month, with returns of 11.25% over three months, 17.13% over six months, and 29.11% on a one-year basis

Mumbai, Jan 10, 2026: According to Motilal Oswal Mutual Fund’s Global Market snapshot report, Nifty 500 remained flat in December but closed the year with a +6.7% gain. Midcap and Smallcap were slightly negative for the month, down by around 0.2% to 0.5%. The Nifty 50 declined by 0.28% over the last one month. The index delivered gains of 6.17% over three months, 2.40% over six months, and 10.51% on a one-year basisThe Nifty Next 50 posted a monthly gain of 0.33%. The index recorded returns of 2.24% over three months, 0.53% over six months, and 2.02% over one year. The Nifty Midcap 150 declined 0.53% over the one-month period and over the last three months, six months, and one year, the index delivered returns of 5.89%, 1.31%, and 5.37%, respectively. The Nifty Smallcap 250 declined 0.29% over the month. The index saw a decline of 0.05% over three months, while returns stood at −6.25% over six months and −6.01% over the one-year period. The Nifty Microcap 250 declined 2.46% over the last one month and delivered returns of −1.49% over three months, −6.83% over six months, and −9.95% over one year.The Nifty 500 recorded a monthly decline of 0.26% and over the last three months, six months, and one year, the index delivered returns of 5.00%, 1.08%, and 6.69%, respectively.

Among sectors, Metals gained 8.5% during the month, with returns of 11.25% over three months, 17.13% over six months, and 29.11% on a one-year basis. The Auto sector registered a gain of 1.49% over the last one month and over three-month, six-month, and one-year periods, the sector delivered returns of 6.21%, 18.08%, and 23.45%, respectively.

The Banking sector delivered returns of 9.05% over three months, 3.96% over six months, and 17.15% over one year. IT posted marginal gains. Consumer Durables, Healthcare, and Realty declined by around 2% to 3% in December.

The Defence sector declined 3.28% over the last one month however delivered a gain of 19.30% over the one-year period. Realty sector declined 2.79% over one month and −16.57% over the one-year period.

Factors were mixed. Value gained +3.1%, while Momentum fell 3.8% in December.

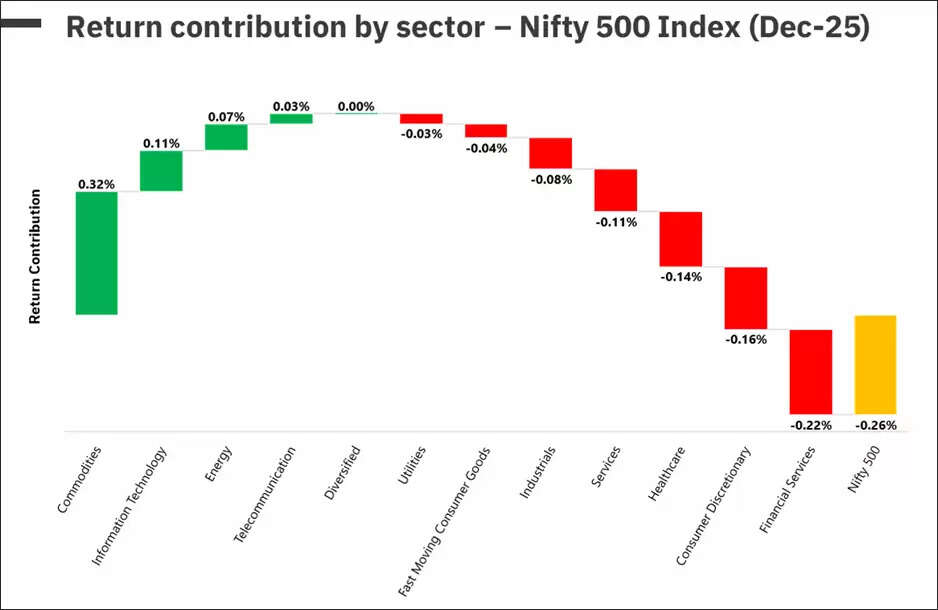

Commodities, IT, and Energy were positive contributors, while Financials, Consumer Discretionary, and Healthcare dragged the Nifty 500 lower.

US equities moved within a narrow range amid low activity. Nasdaq 100 fell 0.7%, while DowJones rose0.7%. In the S&P 500, Financials, Industrials, and Consumer Discretionary were key positives, while Healthcare, Utilities, and Consumer Services contributed negatively.

Within emerging markets, Korea (+12.6%) and South Africa (+9.1%) led, while Brazil (-3.5%) and China (-1.5%)delivered negativereturns.

Gold (+4.2%) and Silver (+33.5%) extended their bull run. Bitcoin (-4.3%) and Ethereum (-1.6%) were weak in December.

Quick Take

- India: CPI inflation stayed low but inched up to 0.71% in Nov (vs 0.25% in Oct). The RBI cut the repo rate to 5.25% in Dec, while the 10 year G sec yield held near 6.57%, indicating broadly stable policy and rates.

- Domestic momentum remained healthy with Composite PMI at 58.9 (still firmly in expansion) and GST collections staying strong at ₹1.74 lakh cr.

- United States: CPI inflation eased to 2.7% in Nov (vs ~3% earlier), with the Fed funds target at 3.75% and 10 year Treasury yields around 4.17%.

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal