Pre IPO investment is now a reality for Udaipur investors

Pre-IPO investing is when you invest in a private company before its initial public offering (IPO). An IPO is when a company’s shares trade on a stock Exchange (BSE,NSE) publicly for the first time. Simply put , it is an opportunity to invest in companies before it gets listed on the Stock Exchange (BSE,NSE)

Pre-IPO investing is where the money is. They have the potential to bring in massive gains. Gains you don’t see on the stock market. Earlier It used to be only for HNIs and the average investor could invest only in publicly traded companies. But times have changed and now it is being made available to Retail Clients as well. You can now create a portfolio for as low as INR 1 lac only !

Sources of Pre-IPO Stocks ?

Pre- IPO stocks are mainly sourced through promoters themselves, Private Equity (PE) firms and Venture Capitalists(VCs) or ESOPs (Employee stock ownership Plan)being sold by employees. PE and VC funds are strategic investors in a company who make time bound investments and at times look for a suitable exit opportunity at reasonable valuations. Promoters may also sell their stake partially to meet out capital requirements and similarly employees also sell their stocks received under ESOP to a third party.

Benefits of Pre-IPO Investing

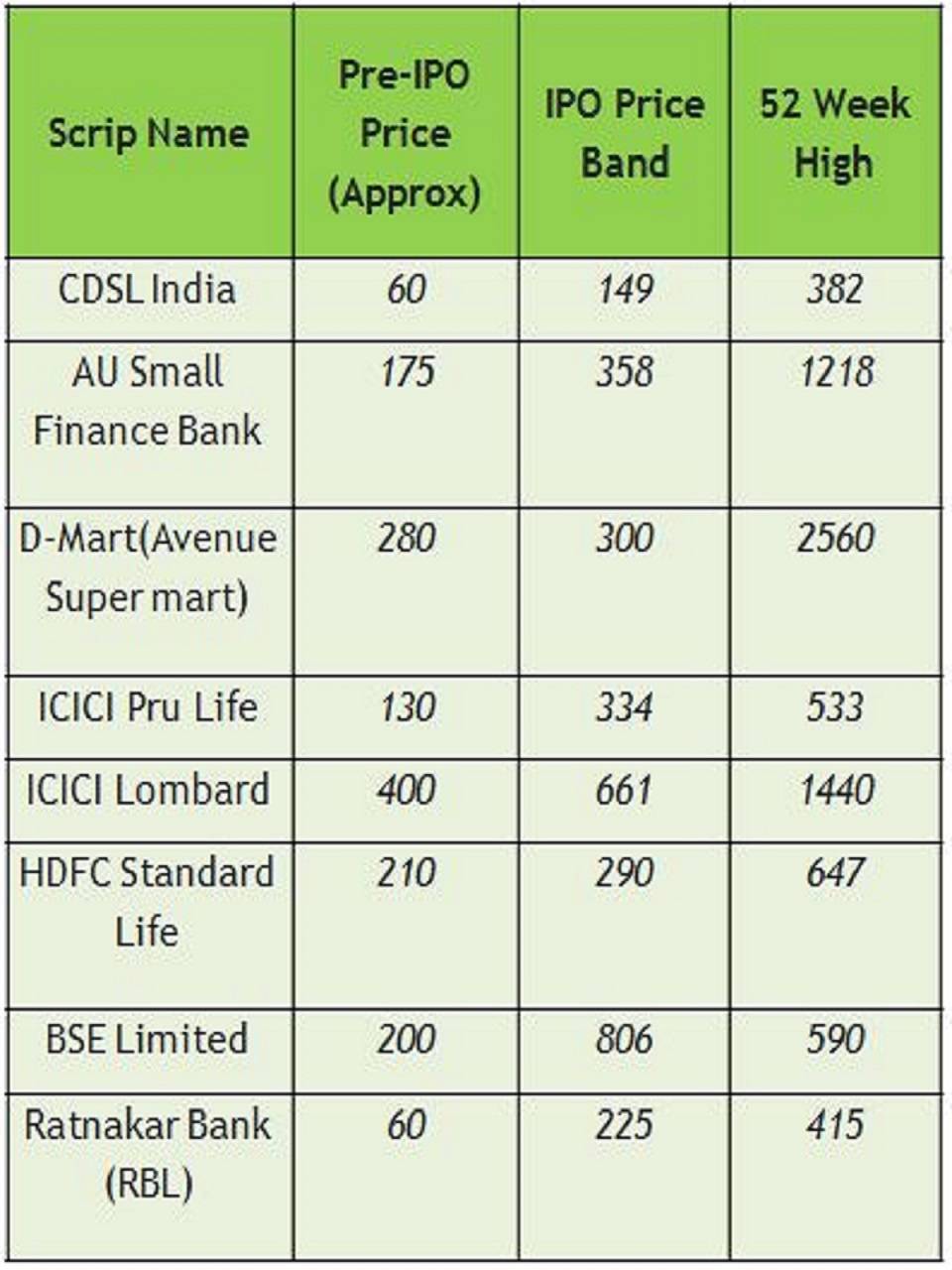

The first and biggest reason for pre-IPO investing is the GAINS it can generate. Pre-IPO investments can lead to tremendous returns for investors. Valuations of Private or unlisted stocks can rise multi-fold before formal listing if chosen wisely .Below are a few examples:

Secondly, there is a certainty of Allotment or guaranteed allocation in Pre-IPO scrips vis-à-vis IPO. Most IPOs for good Companies get oversubscribed heavily and retail Investors are allotted negligible shares on a prorata basis.

Thirdly , there are certain companies which are not available in listed space like Paytm or Chennai Super Kings which prompts the Investors to go in for Pre-IPO Purchase.

Fourthly, Investors tend to invest with long-term perspective in Pre-IPO Stocks given limited liquidity vis-à-vis listed ones and lock in clause post ipo. Equity usually delivers better returns in long term and hence benefits Investors.

Yet Another benefit is avoiding stock market volatility. Unlisted stocks do not fluctuate as much as their listed peers as they are isolated from stock market and immune to panic.

Also Unlisted Stock Investor is eligible for all Dividends, Stock Splits and bonus shares as and when declared by the Company.

Depending on the company, pre-IPO investing isn’t affected as much by events such as the 2008 financial crisis or the 2020 corona virus pandemic. On the other hand, the events can still impact companies and the Investment.

Which companies are available in Pre-IPO Market ?

There are several unlisted companies which have been performing really well and are available in Pre-IPO market across Sectors. To name a few – Companies like Anand Rathi Wealth(Wealth Management), Barbeque –Nation Hospitality(Restaurant) , Bira Beer( Alcoholic Beverages), Bharat Hotels(Hotels) , Capital Small Finance Bank ( SFBank), Carrier Air Conditioning(Air-conditioning Cons Durables), Cochin International Airport(Airport), Chennai Super Kings(Entertainment), Fino Pay-tech payments bank(Payments bank), Hero Fincorp (NBFC), HDB Financial Services(NBFC), HDFC Securities(Stock Broking), Kurlon Ltd(Furniture’s), Lotto India (Confectionary), Mohan Meakins (Alcoholic Beverages), Philips Lighting India (Lighting Fixtures), National Stock Exchange(Stock Exchange), Paytm(E-Commerce), Care Health Insurance (Gen Insurance, formerly Religare health), Reliance Retail(Retail), SMC Global(Stock Broking), Studds Accessories(Auto parts), Suryoday Small Finance Bank(Small Finance Bank), Tata Technologies( Engineering, R&D), Utkarsh Microfinance(Small Finance Bank), UTI AMC(AMC) etc are available as on 1st September 2020.

Is it Risky to Invest in Pre-IPO ?

Absolutely. Every Investment be it listed Shares or Mutual Funds has some form of risk associated with it. The investment world works on a simple principle of risk-reward. Higher risk offers a better possibility of earning higher returns and vice versa.

Pre-IPO carry the same risk as the listed ones. Additionally Investor should clearly understand that :

Liquidity of unlisted stocks is less however better than Real Estate Investments.

Secondly, Unlisted stocks can be traded freely before IPO however there is a lock-In period of 1 year Post IPO.

Thirdly, Information and other Financial data for Unlisted stocks is not as readily available as for Listed Stocks.

Finally, IPO of an unlisted stock may take a longer time than expected and gains may not be as per expectations or may even lead to a Capital loss. Thus one should only invest with a longer horizon of atleast 3-4 years to reap the benefis.

Investors should clearly understand the risks involved and invest basis their Investment objective, Risk Appetite, financial resources, Knowledge & experience in unlisted space and with a long horizon only .

Also one should diversify his/her investments between different companies operating in different sectors and exposure to unlisted stocks should be limited to 10% of one’s Net Worth as a thumb rule.

Factors deciding Pricing for an Unlisted Stock

There are multiple factors which decide the pricing of an Unlisted Stock. Common Factors include:

- Valuation by Comparison with the stock Market Capitalization of similar company in listed space. It can be a Price to book or Price to earnings ratio of a similar company in the Industry. Eg. HDFC Securities(unlisted) can be compared with its listed peer ICICI Securities.

- Demand v/s Supply is a major factor driving prices for both listed and Unlisted stock. Valuations for a popular brand can be unrealistically high basis demand-supply gap with a high PE multiple and one needs to be cautious on this before investing.

- Business fundamentals like Revenues, Profitability, Market share of company, Assets, liabilities , Quality of Management and growth potential decide the pricing for any business. They should be studied and co-related with the pricing prior to any Investment.

- Positive or Adverse news also affect the prices for unlisted securities. Recent Investments in Reliance Industries and merger with future group for retail business have led to an approximate 50% hike in pricing for Reliance Retail Stock(Unlisted) recently.

Taxation for Unlisted Stocks

Taxation is an important aspect which needs to be understood well by the Investor prior to Investments in Pre-IPO stocks.

Unlisted stocks are taxed basis period of Holding. Gains are considered Long Term if shares are held for more than 24 months( which is 12 months for listed stocks) and Short term if sold/transferred before 2 years. Period of holding will be computed from the date on which the stock was acquired until the date of its sale.

In Case of an Individual or HUF, Long term gains will be taxed at the rate of 20% with Indexation benefit*

(*Indexation is a method used to determine the value of an asset/stock after taking inflation into consideration. Inflation index is published by Income tax for the year. When computing tax, indexation reduces one's tax liability.)

If the stocks are held for less than 24 months, the Gains are added to your Income and Short term Capital gain/STCG is taxed as per Tax slab applicable to an Individual/HUF.

Conclusion :

Pre-IPO Shares offer an excellent investment opportunity focusing on long term wealth creation. All one needs is a Demat account as unlisted securities are only delivered in dematerialized form.

However Investor should clearly understand the risks involved and invest only with a long term perspective considering his/her risk appetite and should take help of his/her Financial Advisor specializing in unlisted securities. Investment should always be backed by detailed research reports.

A carefully chosen portfolio could be worth the Risk !

The author, Saurabh Agarwal is founder of The Wealth Advisors and LoanGurus. He has worked for Citibank, India in the past. For other information or Pre-IPO investing and portfolio creation, he can be reached out at saurabhaggrawal@yahoo.com.

VIEWS EXPRESSED ARE SOLELY of the AUTHOR

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal