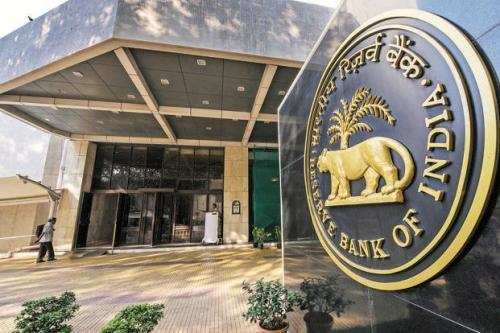

RBI asks banks not to impose restrictions on customers regarding KYC

RBI stated that the banks will not take any action till year end against customers for not updating KYC in view of second wave of corona.

No restrictions will be imposed on customers unless warranted due to any other reason or under instructions from court.

KYC norms have been relaxed by RBI. RBI issued directives on Wednesday regarding updating KYC details telling all banks that no restrictions must be imposed on customers till December end in view of the second drastic wave of corona virus.

RBI (Reserve Bank of India) has also decided to extend the scope of video based customer identification process (V-CIP) and video KYC (know your customer) for new customers like proprietorship firms, authorized signatories and beneficial owners of legal entities.

"Keeping in view the COVID-related restrictions in various parts of the country, Regulated Entities are being advised that for the customer accounts where periodic KYC updating is due/pending, no punitive restriction on operations of customer account(s) shall be imposed till December 31, 2021," RBI Governor Shaktikanta Das said while announcing steps to deal with the COVID pandemic.

Banks will not impose restrictions on customers unless warranted due to any other reason or under instructions of any court of enforcement agency. RBI Governor also said that RBI stands in “battle readiness” to ensure that financial conditions remain congenial and that markets continue in efficient manner.

The above directives came in after one of the banks announced on 3rd May, 2021 that it will freeze accounts of the customers if the KYC is not updated by 31st May. Though the bank also gave the option of online updation, yet there may be customers who are either in isolation or under home quarantine or hospitalised and unable to update their details in any way.

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal