14 National Highway stretches in Rajasthan to be monetised under NMP by 2025

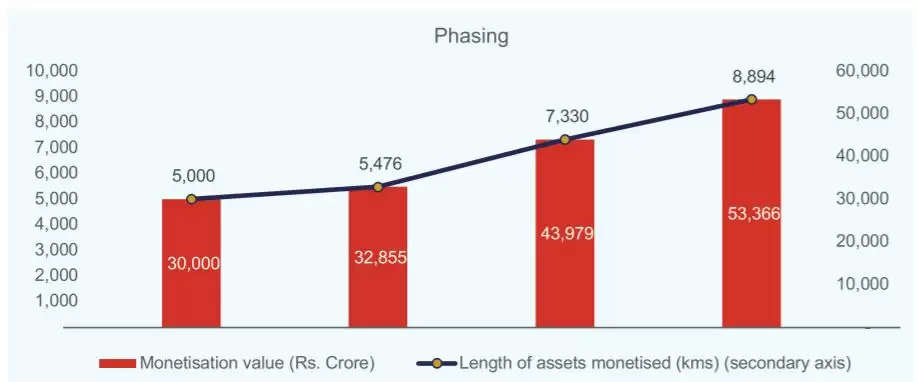

Finance Ministry has launched an ambitious medium-term National Monetisation Pipeline (NMP) to monetize Rs 6 Trillion of brownfield infrastructure assets over a period of four years.

14 National Highway stretches in Rajasthan including the Abu Road - Swaroopganj NH27 have been placed under the recently announced National Monetisation Pipeline (NMP) program asset class as brownfield assets. The 14 National Highways include a total of approximately 1076km under the following zones:

- Agra Bharatpur (UP/Rajasthan): 45km (of which approximately 20km is in Rajasthan)

- Chittorgarh-Kota and Chittorgarh bypass: 161km

- Palanpur-Abu Road (Gujarat/Rajasthan): 45km (of which 10km is in Rajasthan)

- Abu Road–Swaroopganj: 31km

- Baran - Shivpuri: 121km (of which 110km is in Rajasthan)

- Rengus - Sikar: 44km

- Jaipur - Kishangarh: 90km

- Bharatpur - Mahua: 57km

- Mahua - Jaipur: 108km

- Jaipur - Reengus: 52km

- Suratgarh - Sri Ganganagar: 78km

- Kota - Chittorgarh (RJ7 and 8): 128km

- Kota - Baran - Shivpuri - Jhansi (Raj/MP/Guj): 300km (of which approximately 187km is in Rajasthan)

Under the NMP program,. assets which was central to the business objectives of a public entity / statutory body / government body and/or are bing utilised for delivering infrastructure services to public/users have been categorised as Core Assets for the purpose of monetisation. the aggregate length of R-H assets considered for monetisation over EY 2022-2025 is 26,700km (approximately 22% of total highways length of 1,21,155 km across India, excluding those already being operated under BOT (Toll) based PPP concessions. This is based on the length of the already / to-be operational, four lane highways and above in the country, entailing potential for revenue generation and thereby monetisation.

Factors influencing monetisation of National Highways

As per the policy document, Roads and Highways, as an asset class, has steadily developed a solid track record of monetisation. The monetisation of operating road assets has generated growth capital for construction of new roads under the Bharatmala programme, in line with the NHAI’s mandate to diversify its funding for financing growth. Since 2017, the NHAI has been successfully monetising its brownfield road assets through Toll Operate Transfer (TOT)-based PPP concessions. The TOT model has since matured and is now an established model with a model concession framework already in place. Another method of monetisation that has seen traction in the recent past is the InvIT model. A number of road assets have previously been monetised through InvITs by private sector players. InvIT are collective investment vehicles similar to a mutual fund, which enables direct investment of money from individual and institutional investors in infrastructure projects to earn a small portion of the income as return.

How will Transparency be ensured

Introduction of measures such as FASTag, electronic tolling, etc., and the palpable behavioural change seen in the adherence to these initiatives, will usher in greater transparency in the asset management process and significantly improve user “willingness to pay”. This will result in asset aggregators with sound corporate governance practices, such as Infra focussed PE funds, sovereign wealth funds, pension funds, etc., participating in operational road assets with established base traffic Thus, existing asset owners such as the NHAI will be able to effectively churn their investments and perpetuate a virtuous cycle of “build, commission and monetise” to generate growth capital for fresh investment.

Reference Source: NITI Ayog

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal