Direct Tax Dispute Resolution Bill not to benefit Launderers

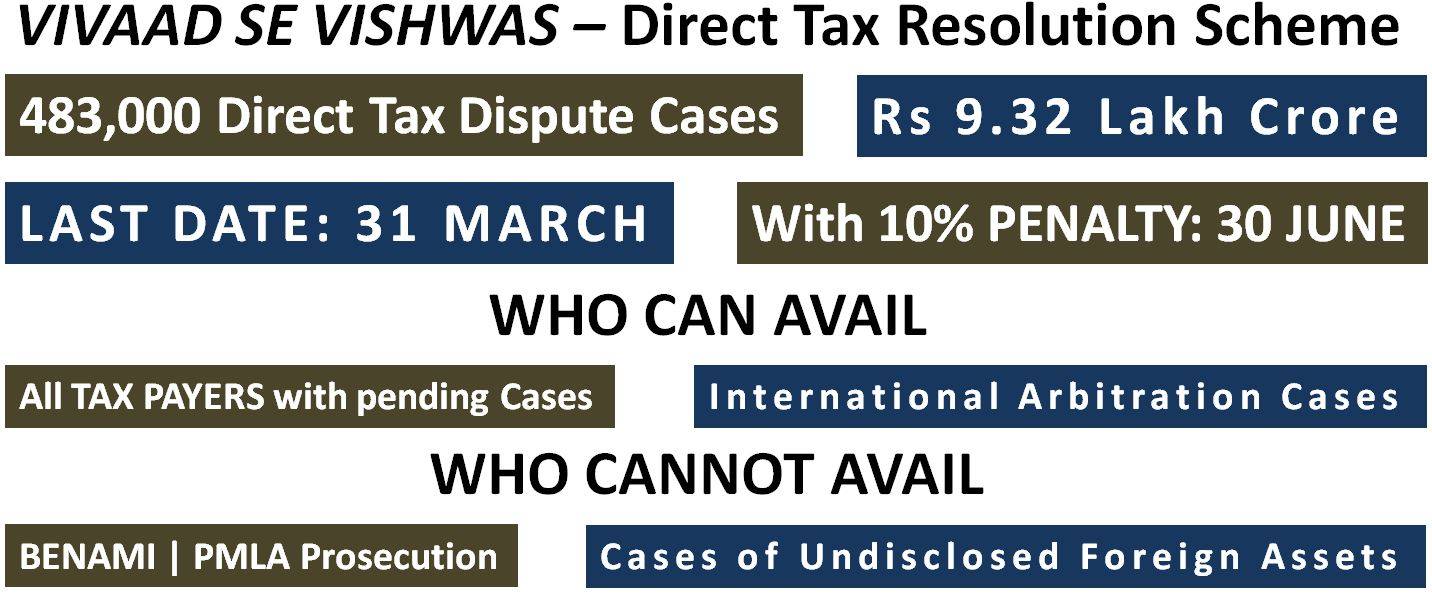

Further to tabling of the Direct Tax Vivad se Vishwas Bill in the budget speech by Nirmala Sitharaman on 1 February 2020, the Income Tax regulators have clarified that launderers will not be permitted to avail the scheme.

Accordingly, cases related to undisclosed overseas assets initiated on the basis of information from another country will not be covered under the new dispute settlement mechanism (scheme) for Direct Tax. Prosecutions under the Prevention of Money Laundering Act (PMLA), Income Tax Act and Benami Transactions (Prohibition) Act will also not be covered under this scheme.

The Vivaad Se Vishwas Bill looks at resolving the 483,000 disputed tax cases stuck in various courts across the country, worth well over Rs 9.32 lakh crore. Foreseeing the unnecessary expenses that both the taxpayers and government will incur, this scheme seeks to emphasize on trust building, said the Finance Minister while tabling the bill in her budget speech.

Further on, to make things more specific, the decision taken by the tax authorities and the liability computations will be final and binding and no appeal can be made against such.

Income tax officers will be asked to convince taxpayers to opt for resolution under the scheme and will be rated on the success in this.

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal