PPF Interest Rates remain unchanged, NSC gets maximum hike in Interest Rates

The Interest Rate on National Savings Certificate has been hiked from 7% to 7.7% for the April - June 2023 Quarter

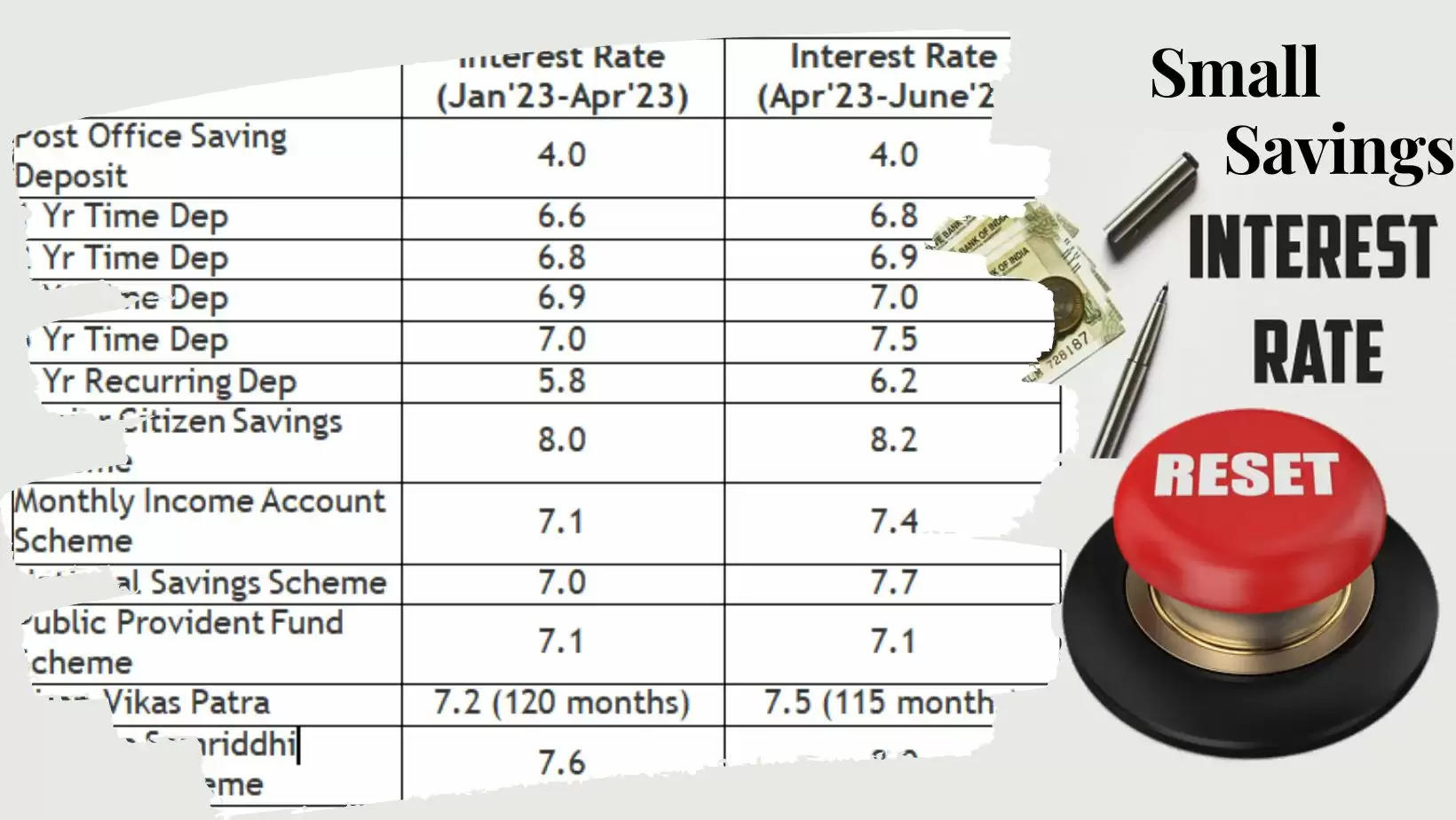

The Central Government, vide its circular issued on 31 March 2023, has hiked interest rates across various government Small Saving Schemes for the period 1 April 2023 till 30 June 2023.

While the Interest on Public Provident Fund Scheme remains unchanged at 7.1%, the Interest on National Savings Certificate has been given the maximum increase of 70 basis points from 7% to 7.7%. The interest rates on all the Small Saving Schemes is as follows:

| Instrument | Int Rate (Jan'23-Apr'23) | Int Rate (Apr'23-June'23) |

|---|---|---|

| Post Office Saving Deposit | 4.0 | 4.0 |

| 1 Yr Time Dep | 6.6 | 6.8 |

| 2 Yr Time Dep | 6.8 | 6.9 |

| 3 Yr Time Dep | 6.9 | 7.0 |

| 5 Yr Time Dep | 7.0 | 7.5 |

| 5 yr Recurring Dep | 5.8 | 6.2 |

| Senior Citizen Savings Scheme | 8.0 | 8.2 |

| Monthly Income Account Scheme | 7.1 | 7.4 |

| National Savings Scheme | 7.0 | 7.7 |

| Public Provident Fund Scheme | 7.1 | 7.1 |

| Kisan Vikas Patra* | 7.2 (120 months) | 7.5 (115 months) |

| Sukanya Samriddhi Account Scheme | 7.6 | 8.0 |

Annual Interest Rate compounding will be applicable on Post Office Saving Accounts, NSC, PPF, KVP and Sukanya Scheme. Interest Rates will be compounded Quarterly for the Time Deposit and Recurring Deposit schemes as well as for the Senior Citizen scheme. The Interest Rates compounding frequency for the Monthly Income Account will be Monthly.

Importance of Shyamala Gopinath Committee

Interest Rates are reviewed each quarter and if it is mandated then the rates are changed on a quarter basis. The Interest Rates for Small Savings Schemes are linked to government bonds. The formula to arrive at the rates was given by the Shyamala Gopinath Committee. As per the Committee suggestions, the interest rates of different schemes should be 25-100 basis points higher than the yields of the government bonds of similar maturity. One Basis Point is equal to 0.01%. Or 100 Basis Points is equal to 1%.

To join us on Facebook Click Here and Subscribe to UdaipurTimes Broadcast channels on GoogleNews | Telegram | Signal